Stop-loss and take-profit orders are the basic concepts that every financial investor have to know. Especially, with the strong development of cryptocurrency market and the advent of many theories and tools to support market analysis, a method of optimizing investors’ trading is essential. This article will give detail information about Stop-loss and Take-profit order and how to place these orders.

What is a Stop order?

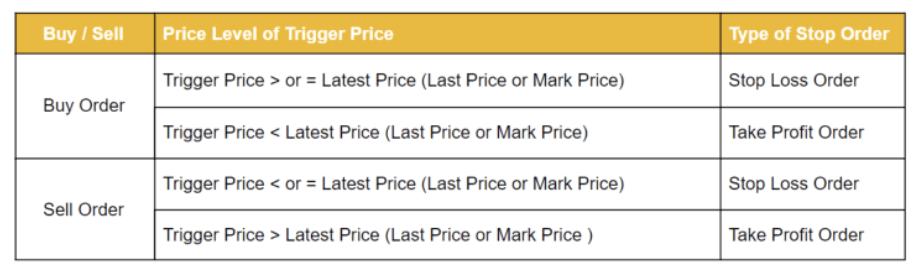

The combination of stop-loss and take-profit orders on Binance Futures creates a stop order. Based on the price level of trigger price against the last price or the mark price when the order is placed, the system will decide whether the order is SL or TP. It is considered as a free insurance policy for your transactions.

What is entry?

Entry is the initial price of a transaction. If the investor finishes the order correctly at the entry point, the order is considered breakeven.

>>> Related: Guide to sign up for Binance account update 2022

What are stop-loss and take-profit orders?

-

Stop-loss order

Stop-loss (SL) order allows the investor to minimize losses by automatically closing a position for expected losses if the price of the asset reaches the predetermined level. Placing stop-loss order is based on the following rules:

- For Buy orders: Stop-loss price < Entry price

- For Sell orders: Stop-loss price > Entry price

→ Note, it is not recommended to place a stop loss order too close to the Entry point to avoid highly volatile market.

-

Take-profit order

Take-profit order allows the investor to make profits by automatically closing a position for expected gains if the price of the asset reaches the predetermined level. Investors place stop-loss order based on the following rules”

- For Buy orders: Take-profit price > Entry price

- For Sell orders: Take-profit price < Entry price

In addition to basic orders, Stop loss – Take profit is an advanced order, like stop-limit orders and Binance OCO orders.

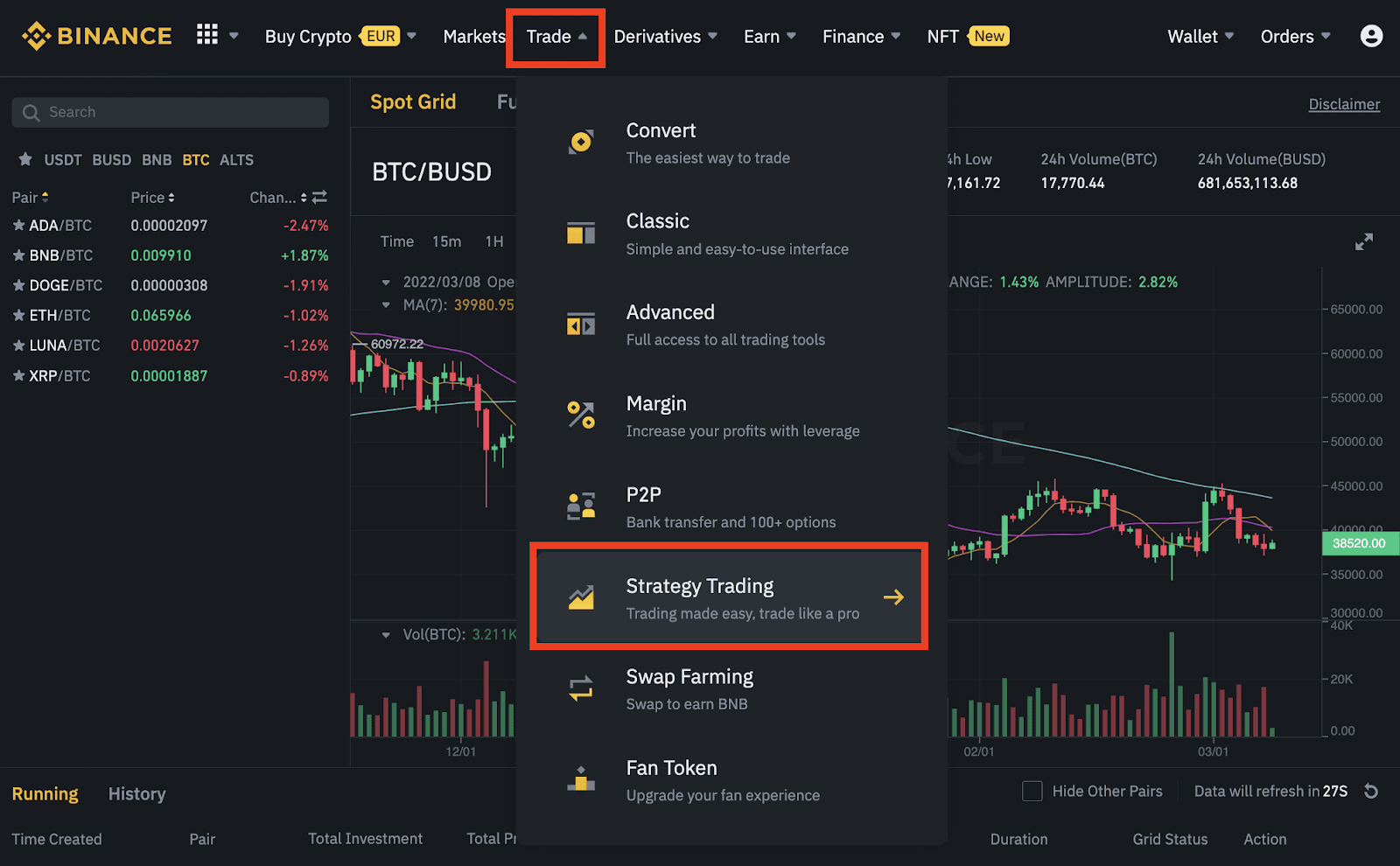

How to place Stop-Loss and Take-Profit orders on Binance

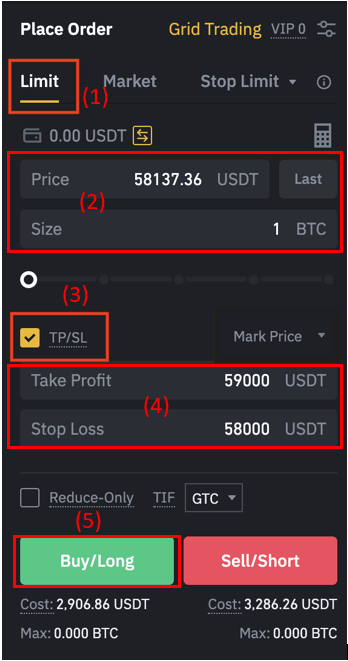

When placing a Limit or Market order, the investor can simultaneously place a stop- loss and take-profit orders.

- Step 1: Go to [Future], tap [Limit] or [Market] order

- Step 2: Enter the price specified entry point and your position size

- Step 3: Tick the box next to [TP/SL]

- Step 4: Set the price of Take Profit and Stop Loss

- Step 5: Tap [Buy/Long] to place an order

For example, an investor who bids a Take Profit of $59,000 and a Stop Loss of $58,000 will get the following results:

- If the price ends at the profit-taking point, the investor will profit 59000 – 58137.36 = 862.64 USDT

- If the price ends at the stop-loss point, the investor will lose 58000 – 58137.36 = 137.36 USDT

Note: If the investor is using hedge mode, the profit-taking and stop-loss function is only available with open orders.

Pros and cons of stop-loss and take-profit orders

Advantages

- Saving time: Once placing stop-loss and take-profit orders, the investors do not need to constantly check the trading status.

- More comfortable in trading: Placing these orders makes the investor reduce the pressure throughout your trading journey. You can gain profit or lose within the acceptable level which is usually about 0.5-1% of the investor’s assets.

- Optimizing profits: The investor can place a smaller stop-loss order than the take-profit order from the price at the entry point. After many transactions, take-profit orders can make up for stop-loss order.

Disadvantages

- As mentioned above, when the market is highly volatile, the investor will deal with a Stop Loss scan. After that, the price returns to the entry point of the order or Take-profit because the investor has placed the stop-loss order too close to the entry point.

- Besides, investors will likely lose their good position. Sometimes, the position of the investor when placing orders is good and difficult to return. At this point, the transaction will pass the take-profit point and go even further.

Note

- The increase or decrease of TP/SL activate positions can close all investor positions.

- The TP/SL of the first matched order will be used to take profits and cut losses for all investor positions. TP/SL will be automatically canceled when a new order is created.

- The investor can see that TP/SL has not matched in the order being opened.

- The TP/SL function will not be displayed in the investor’s position and does not support the position closing function.

Conclusion

Stop-loss and take-profit orders are important for experienced investors and professional to trade safely, efficiently, save time, preserve funds and lower the stress throughout your trading journey. Investors and traders should take a potential opportunity and build investment strategy to earn profits and mitigate risks.