Spot grid trading is a tool to help investors optimize profits on every small fluctuation of the market. However, not everyone knows how to use automatic parameters in Spot grid trading, especially for new investors in the market.

What is grid trading?

Grid trading is a tool that automates buy or sell orders for a certain period of time and a configured price range. This feature will help users profit from small fluctuations in price. It is most effective when the market is volatile and sideways.

You can customize and set parameters for the grid to determine the profit area from price movements for your purpose and financial ability.

Note: Only 1 grid strategy can be built for each trading pair, and you can only build up to 10 grid strategies.

How to use spot grid trading parameters

To use Spot Grid trading parameters easily, you can follow these steps.

Step 1: Log in to your Binance account. Tap [Trade] – [Strategy Trading] to enter the Spot trading interface

Method 1: Use auto parameters

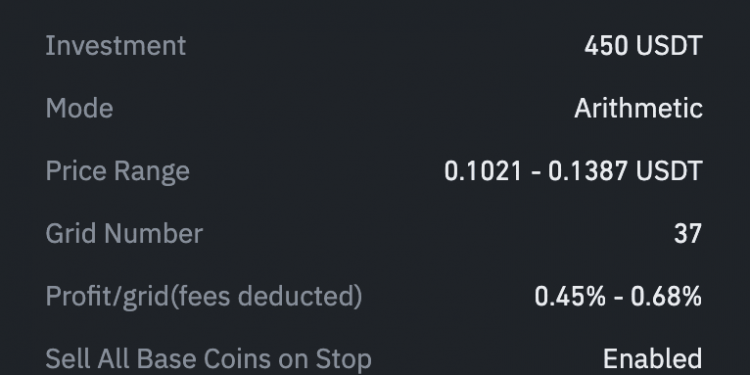

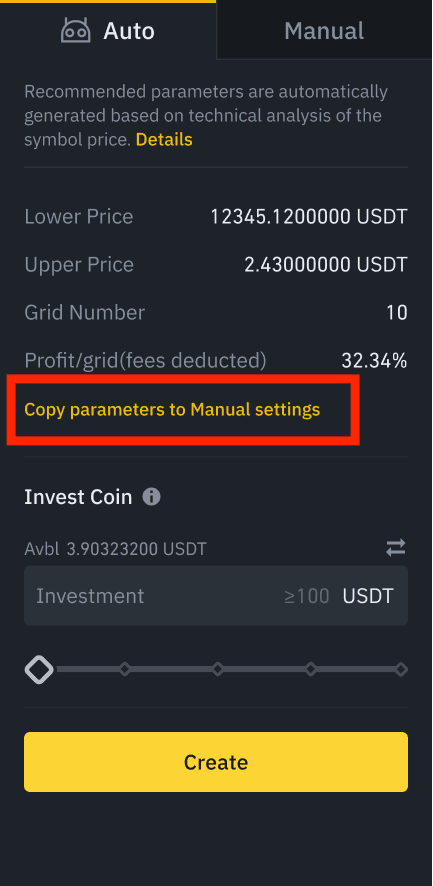

Step 3a: After the two steps above are completed, press the [Auto] tab. You’ll see the proposal parameter created based on a technical analysis of the asset.

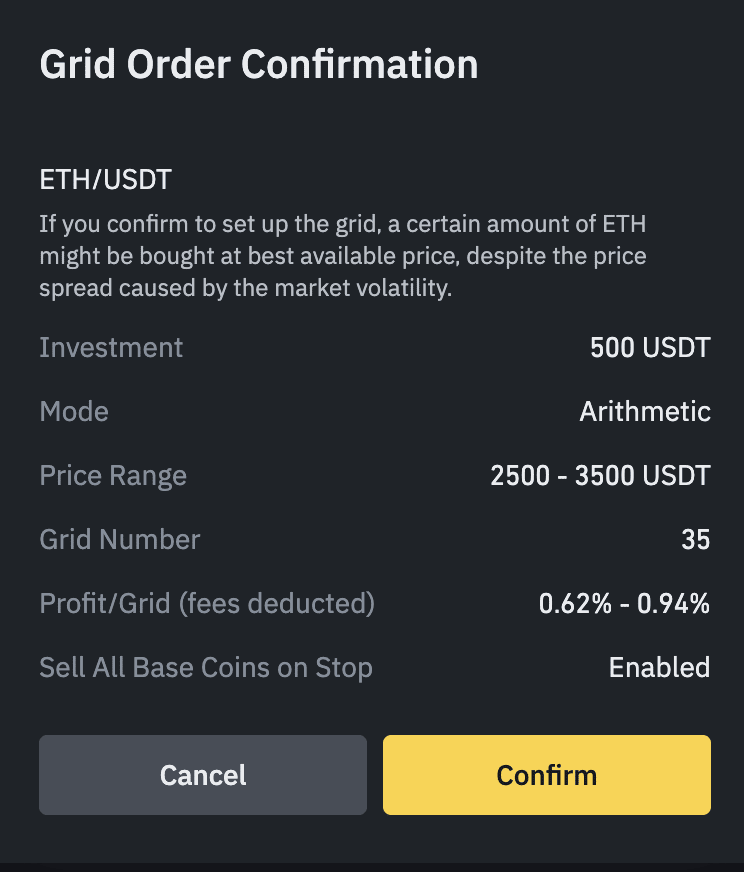

Step 4a: Check the order details, click [Confirm].

The system will automatically place a buy or sell order at a configured price. The proposed parameters are set to Arithmetic mode by default.

Click [Confirm] to place Spot Grid Trading orders.

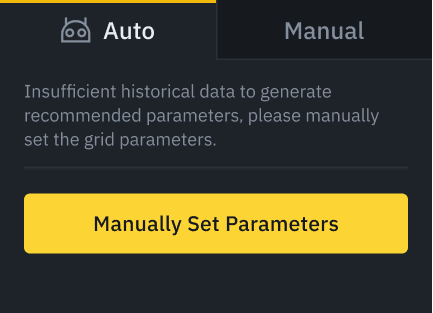

You’ll see a message below if there is not enough data in the transaction pair. The system requires data to be available for at least 21 days to create suggested parameters and the amount of data required may change in the future.

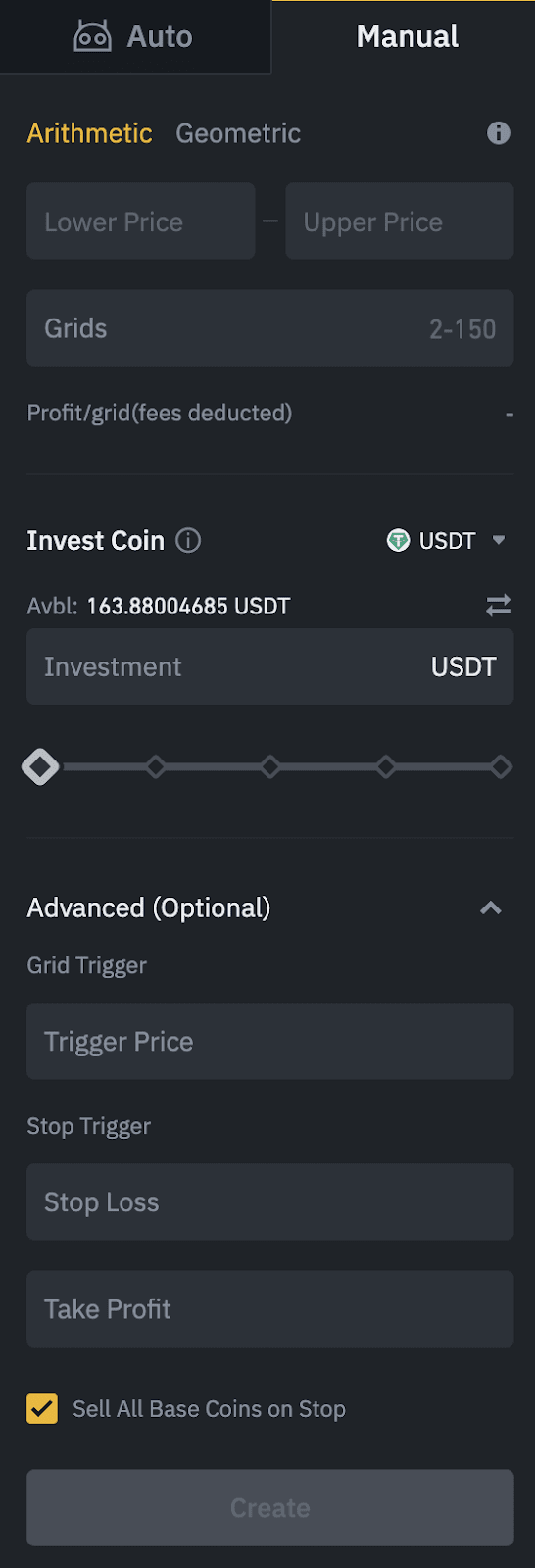

Method 2: Manual set parameters

Step 3b: Click on the [Manual] tab, and then press [Copy parameters to Manual settings] After that, you can manually set the parameters to suit your strategy.

How to calculate auto parameters?

In order to have effective grid transactions, you need to know the relevant parameters to manage the risk level of each strategy.

Lower price and upper price

Lower price: The bottom of the grid trading price bracket. The system will no longer execute orders when the market price is lower than the Lower Price.

Upper Price: The top o the grid trading price bracket. The system will no longer execute orders when the market price is higher than the Upper Price.

- Upper band = MA + BBM * Standard deviation

- Lower band = MA – BBM * Standard deviation

For example: MA = $300, BBM = $400, standard deviation = 0.5

- Upper range = 300 + 400*0.5 = $500

- Lower band = 300 – 400*0.5 = $200

Grid number

Grid number = (Upper limit – lower limit)/ATR*

* Average True Range (ATR) in previously predefined hours of the selected symbol.

For example: The upper limit is $600, the lower limit is $200. ATR is 20.

So we have: grid number = (600 – 200)/ 20 = 20

Conclusion

Spot Grid trading is a strategic trading tool, which should not be considered as financial or investment advice from Binance.

Take your own risks when using a grid trading strategy. Binance will not be reponsible for any losses incurred as a result of your use of this feature. You should read and fully understand the guide on spot grid trading, as well as control risk and trading to suit your financial ability.

>>> Related: Binance registration guide update 2022