Currently, both cryptocurrencies and stocks are the investment tools that attract a lot of traders and investors. However, cryptocurrencies are considered as a good alternative to traditional assets. This article analyzes the main differences between the cryptocurrencies and stocks as well as their pros and cons.

What is cryptocurrency?

Cryptocurrency is a digital currency powered by blockchain technology. They are based on cryptographic techniques to secure and verify transactions and often used as a means of exchanging and storing value. Most cryptocurrencies run on decentralized networks, and their market value is driven by supply and demand.

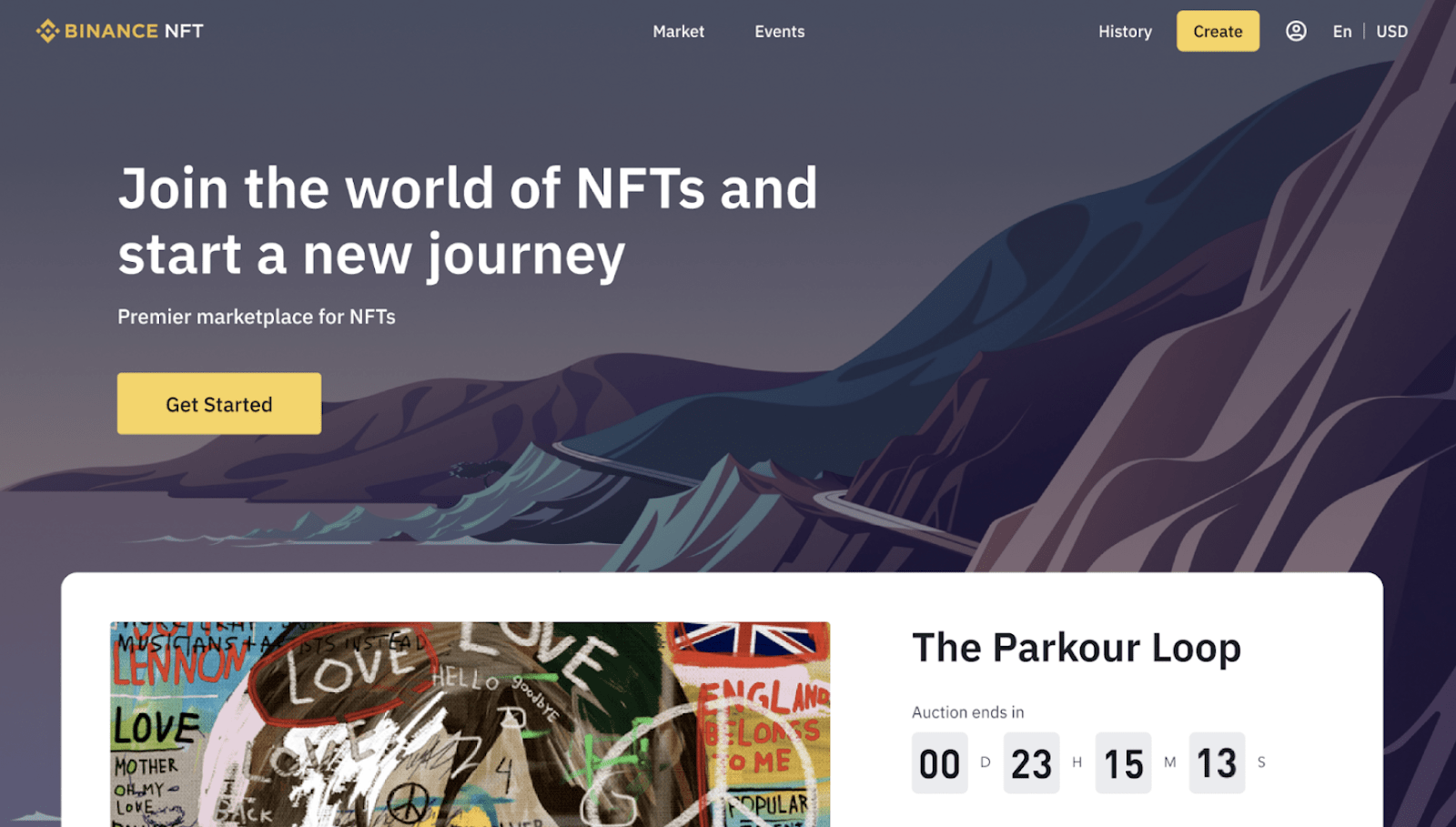

>>> Related: If you don’t have a Binance account, register to start your investment journey.

What is stock?

Stocks represent partial ownership of equity in a business, and they reflect the value of an active company. Sometimes, the shareholders of the stock also enjoy a portion of the company’s profits in the form of dividends. The value of the stock may vary according to the company’s performance and other factors, especially relevant news announcements.

The differences between cryptocurrencies and stocks

Both cryptocurrencies and stocks are used by investors and traders for the purpose of generating profits. However, investing in cryptocurrencies is different from stocks.

Unlike stocks, investing in cryptocurrencies does not come with ownership of a company’s shares. Cryptocurrency investors also don’t receive dividends in the traditional sense. Instead, users can stake or deposit their cryptocurrency tokens to earn passive income.

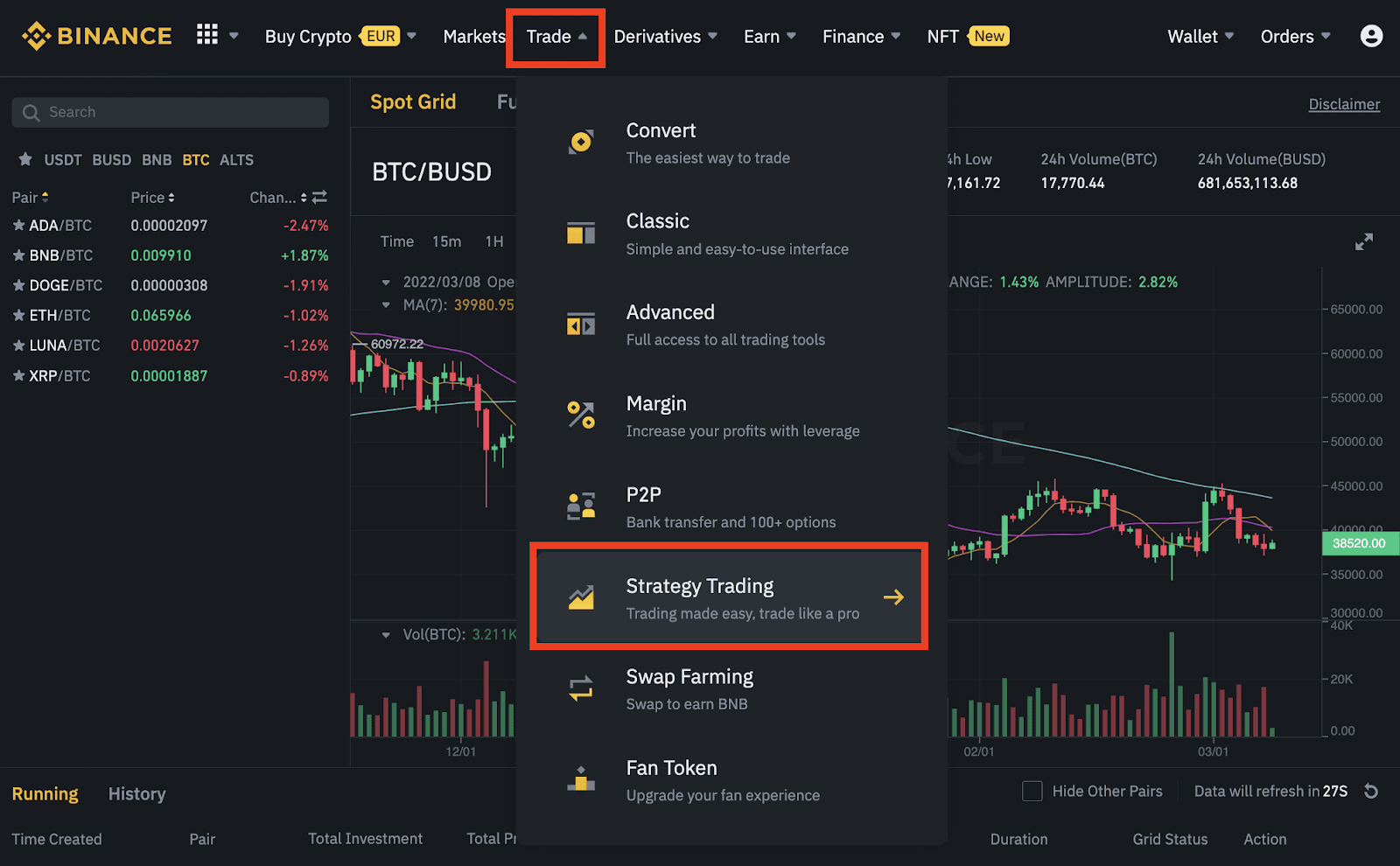

One of the differences between cryptocurrency and stock is the way cryptocurrencies and stocks are traded. You can buy cryptocurrencies at any digital currency exchange at any time, on both day and night, while stock exchanges operate with a limited amount of opening hours on weekdays.

Pros and cons of cryptocurrencies

Advantage

Cryptocurrencies is borderless and everyone with an internet connection can use it.

Decentralized

Most cryptocurrency systems do not rely on central authority that makes crypto currencies resistant to centralized censorship and control.

Inflation-resistant

Cryptocurrencies are not directly affected by the central bank’s monetary policies, so their prices are less susceptible to inflation. However, cryptocurrencies are not all the same, so it’s important to consider the issuance rate and supply of each cryptocurrency asset.

Flexible

Compared to stocks, cryptocurrency allow investors to increase their cryptocurrency holdings besides trading in more ways. Cryptocurrency investors can profit from yield farming, staking and providing liquidity. Products like Binance Earn are a great example of how you can increase your cryptocurrency holdings.

Diversified

The value of many tokens is not just currency. First, Fan Tokens can provide exclusive benefits and perks for token holders with their favorite sports teams or brands. Some cryptocurrencies are governance tokens, which give the owner the right to participate in the development of a corresponding project or protocol.

Disadvantages

Price fluctuation

The cryptocurrency market is famous for its tendency to fluctuate sharply in price. The potential for quick returns can be very attractive to new investors. However, it is a double-edged sword. It can result in equally dramatic losses.

No official regulations

Cryptocurrencies are legal in many countries, but they are not fully regulated and popular. Investors should be careful with potential compliance issues and legal research depending on their location.

Depository risks

Cryptocurrencies like Bitcoin require a private key to access tokens stored in digital cryptocurrency wallets. Forgetting a seed phrase or losing a physical cryptocurrency wallet can lead to the loss of access to your cryptocurrency forever.

Profits are not guaranteed.

Like any financial market, no profit is guaranteed with cryptocurrencies. While Bitcoin and other cryptocurrencies perform well in the long term, there is no guarantee that they will continue to rise in the future and there is always a possibility that they will not perform well in the next investment period.

Pros and cons of stocks

Advantages

Accessible

It’s becoming easier to invest in stocks, with more and more online platforms and mobile apps emerging in the market. Many such services have an intuitive interface and are integrated with other financial services.

Regulation

Many governments strongly regulate the stock market. In the U.S., for example, publicly trading companies must disclose information that could affect the value of their shares to the Securities and Exchange Commission (SEC), the government watchdog in charge of investor protection.

Inflation-resistant

Some stocks, such as Treasury Inflation-Protected Securities (TIPS), can considered as a hedge against inflation.

Diversified

There are many stock options in different industries and sectors for retail investors. Traders can choose equity based on a large amount of criteria, from the company’s trading model and location to whether they pay dividends or not.

Shortcoming

Volatility

Similar to cryptocurrency, the stock market suddenly changes in prices in the short term. If a company performs well, its share price will likely increase. On the other hand, if a company reports losses or receives bad news, the stock’s value will likely go down. Moreover, some stocks may be more volatile than others.

Transaction fees

In most cases, the stock trading fees are relatively high and there are more fees than cryptocurrency trading. Beside brokerage fees and commissions, there are other fees when you buy or sell your shares. Stock exchanges are usually more tightly regulated. The rules to protect traders as well as investors gradually become much stricter.

Profits are not guaranteed

Like any financial market, there is no guaranteed return on stocks. While there are stocks that usually perform better than alternative investments in the long term, it is likely that they do not perform well in the shorter investment period. If the company goes bankrupt, the stock will be worthless in the market, you will have to accept the loss of the investment.

Should you invest in the cryptocurrency or stock market?

Both types of assets have their advantages and limitations. You should make a decision depending on your ability to take risks and other interests. Ultimately, what drives the success of your investment is the ability to weigh between the risk and the returns you get, not the investment vehicle you use. Many experienced investors diversify their portfolios, invest in both cryptocurrencies and stocks.

Conclusion

Beside the similarities, there are clear differences between cryptocurrencies and stocks. In short, cryptocurrencies and stocks are valid investment options and they can serve different purposes in your portfolio. No matter which one you choose, always make sure you are aware of the risks involved.

However, for large investors the characteristics of the cryptocurrency market such as wider reach, the ability to isolate well, free trading fees will make them more interested and invest more.

>> Read more: What is Binance? Binance registration guide update 2022