Launched on September 12, 2019, Binance Futures has paved the way for Binance in particular and the cryptocurrency market in general. 125x leverage creates opportunities as well as risks for risk –appetite traders. Don’t miss this article because it will help you understand what Binance Futures is and how to get involved.

What is Binance Futures?

This is a Binance platform for investors to trade futures contracts. You can take advantage of price volatility for a certain period without the need to possess the underlying asset.

To make it easier to understand, assuming you predict the ETH to rise but after 2 months it actually decreases. As a result, you will lose the difference between the predicted price and the actual price after you make a buy or sell order.

Binance Futures‘ exchange rates are based on four platforms: OKEx, Binance, Bittrex, Huobi.

Futures contracts allow traders speculate upon the direction of the volatility of an underlying asset and use leverage. It helps investors hedge against unprofitable price movements and minimizes risks to the investment portfolio. If you expect the value of an asset to rise, you will buy a futures contract to go long, and if you expect it to fall, you will sell to go short. The outcome of your prediction could result in a gain or loss.

Related: Binance Margin Trading Guide

Advantages and disadvantages of Binance Futures

Advantages

- Very high leverage ratio up to 125x

- High liquidity. Huge transaction volume is favorable for payments

- The interface is easy to use. Available on both the Web and Mobile.

- The fee is based on the leverage ratio, the more you borrow, the higher the charge.

Related: What is binance transaction fee? How to reduce transaction fees on Binance

Disadvantages

- It’s very risky for new people (and the old ones).

- Limit trading pairs to reputable coins.

How to use Binance Futures

Step 1: Log in to your Binance account

You need to log in to Binance’s account then go directly to the homepage. If you don’t have an account, you can read how to register Binance account here.

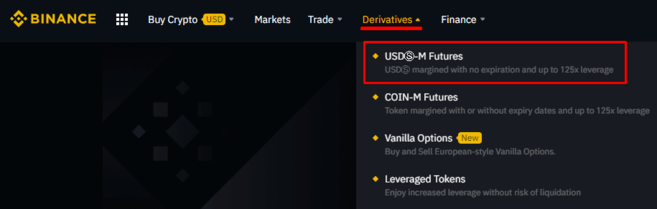

Step 2: Select Binance futures exchange

Move your mouse to the bar at the top of the page, and select the futures contract that you want. There are two types of futures contracts available on Binance: USD(S)-M Futures and COIN-M Futures.

For example: If you would like to trade BTCUSDT perpetual contracts, please click on USDⓈ-M Futures. For BTCUSD Coin-Margined contracts deposited in coins, select COIN-M futures.

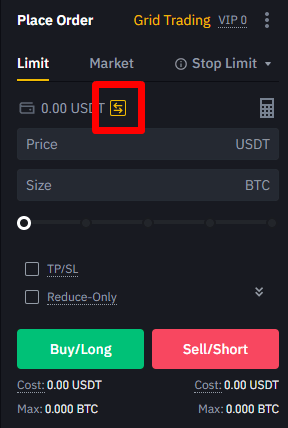

Step 3: Open the order

Here, the screen will show the main interface of futures. At the end of the right corner, click on the Open now button to start opening the order.

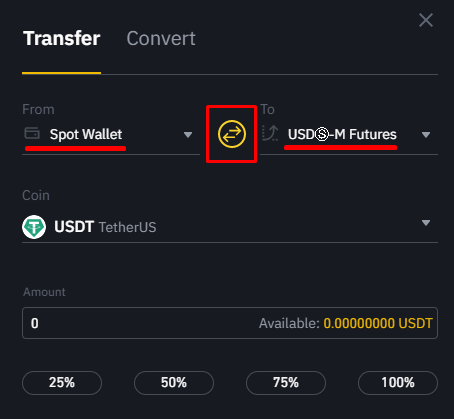

Step 4: Transfer money

You need to make the transfer of funds from the Exchange wallet (the wallet you use on Binance) to the Futures wallet (the wallet you use on Binance Futures). Press Transfer on the right side of the Binance Futures page.

Besides, you can choose the trading volume and trading currency. Set the amount that you’d like to transfer and click on Confirm transfer. You should be able to see the balance added to your Futures Wallet shortly. You can change the direction of the transfer using the double-arrow icon as shown below.

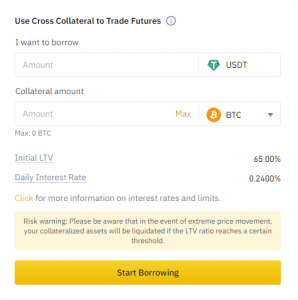

However, you can also use funds in your Exchange wallet as collateral and borrow USDT to trade futures from your Futures Wallet Balances page. Therefore, you don’t have to transfer money directly to your Futures wallet. Of course, then you will have to pay back the USDT you have borrowed.

Step 5: Place an order

You can place orders in one of the following ways:

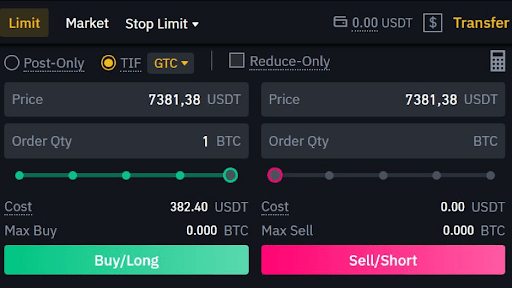

- Limit: This is the most placed order, it matches the price and trading volume once you have entered. When you place a Limit order, the trade will only be executed if the market price reaches your limit price (or better yet). Therefore, you can use the limit order to buy at a lower price or sell at a higher price than the current market price.

For example: You want to sell 1 BTC for $7381.38 USDT. You only need to enter 7381.38 in “Price” and 1 in “Order Qty”. The next “Sell/Short” option is done.

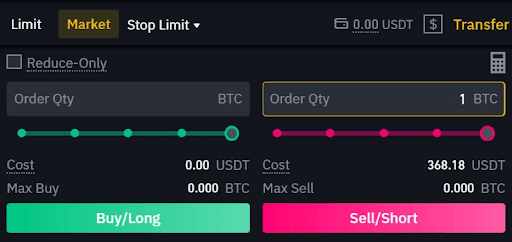

- Market: Few people use this order due to the mechanism of automatically placing orders however the exchange will automatically place orders at the best possible selling price and purchase price. Buy and sell orders at the best price available on the market. It is executed against the limit orders that were previously placed on the order book. When placing a market order, you will pay fees as a market taker.

For example: The market price is $7000/BTC and you anticipate that BTC is still falling and you sell 1 BTC at the current price, just enter 1 in the Order Qty and then press the Buy/Long button.

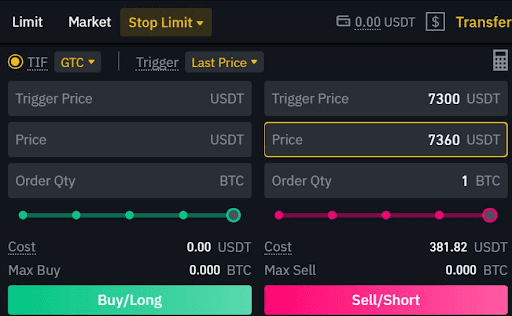

- c: The system will automatically activate the limit order when the market price reaches Stop Price.

For example: BTC price 7000 USDT and you set Stop Price is 7300, the limit price is 7360. Then you put 1 BTC in Order Qty. At this point, when BTC reaches $7300, it automatically activates a Sell order at $7360 USDT.

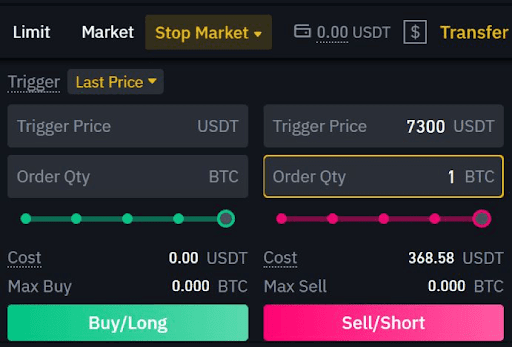

- Stop – market: This order will trigger a market order when the market price reaches a Stop Price.

For example: Trigger Price is 7300 in the amount of 1 BTC. When the price reaches 7300, it activates a Short Market 1 BTC order at the market price.

- Take-profit-limit: Similar to the two orders above. If two stop orders to close losses, this order will help you manage risk and lock in profit at specified price levels. The key difference between a stop-limit order and a take profit limit order is that a take profit limit order can only be used to reduce open positions.

- Take-profit-market: This order is also used to take profits but there will be no limit price

- Trailing Stop: When the market swings, the Trailing Stop order allows the trader place a pre-set order at a specific percentage away from the market price. It helps you lock in profits while limiting the potential losses when a trade does not move in a favorable direction. The Trailing Stop moves by a specified percentage when the price moves favorably. It locks in profit by enabling a trade to remain open and continue to profit as long as the price is moving in the direction favorable to traders. It does not move back in the other direction. When the price moves in the opposite direction by a specified percentage, it will close or exit the trade at market price.

Step 6: Close the order and take profit

You will be able to close the order when placing an order in reverse with the same level of trading volume. If you’ve created a buy order, you’ll now create a sell order and vice versa. In addition, you can also close part of the contract to take profit in advance, not necessarily close the entire contract.

Compare Future and Margin on Binance

For more Futures and Margin comparisons, click here.

Frequently asked questions about Binance Futures

Thousands of users are participating in Binance Futures every day to take advantage of the ever-growing financial market. Crypto derivative trading is more and more popular with traders all around the world. With over 29 million regular users, many questions are frequently asked about this leading derivatives cryptocurrency exchange.

1. Why has the liquidation price changed on Binance Futures?

The liquidation price on Binance Futures is affected by changes of the wallet balance.

For example, when a user has a position in USD(S)-M and COIN-M Perpetual Futures, the liquidation price can be favorable or unfavorable according to the settled funding fee and market conditions. Because the liquidation price in Multi-Asset Mode is calculated on the basis of all collateral assets, it may change more frequently than in Single-Asset Mode. The price of the collateral changes in tandem with the liquidation price.

2. Why can’t I lower my leverage on one of the positions under Isolated Margin mode?

Binance Futures allows users to increase leverage in one position under Isolated Margin mode while it is impossible to lower leverage.

3. Why do I have enough margin but can’t increase the size of the position?

On Binance Futures, the size of the position and the open orders that users can keep for the same symbol are defined in the Leverage and Margin table. The greater the position users want to trade, the lower the restricted leverage.

4. Why are TP/SL orders unable to close positions at a certain price?

On Binance Futures, TP/SL orders are market stop orders. These orders are activated when the stop condition is satisfied. The execution price is entirely based on the liquidity and depth of the market as the market order represents a quick buy or sell action.

- There are two types of triggers for the TP/SL order: mark price and last price. Mark price is the default trigger type, only when the marker price reaches the stop price, the TP/SL orders will be executed. Most TP/SL orders can’t be executed at a certain price as the trigger type is different from the price that the user tracks.

- The price protection mechanism can also have an impact on TP/SL orders. When the price protection is activated, if the difference between last price and mark price of this contract exceeds the set threshold when the TP/SL order reaches the trigger price, the TP/SL order will not be triggered.

- TP/SL orders expire due to the trading rules of the maximum market order quantity.

- Low liquidity also has a serious impact on TP/SL orders. Market orders may expire or be conducted in part because market order price cap/floor ratio is common in low-liquidity market conditions. If it exceeds the threshold, any unfulfilled market orders will expire.

5. Why aren’t limit orders conducted at a preset price?

A limit order allows users buy or sell at a limited price or better. Therefore, if the current market price is better than the limit price, the order will be executed immediately.

6. Why did the limit stop order expire even though I didn’t cancel the order?

On Binance Futures, if the limit stop order is placed to reduce the holding positions, they may expire when the user places a new order to close the position; failed the second margin test; doesn’t have a position that is only reduced; or when the position has been liquidated.

Canceled orders are canceled by the user, whereas the expired orders are canceled by the system according to the conditions mentioned above.

7. Why does the grid trading expire even though I have enough margin?

There are two main reasons why grid trading expire because it operates within the parameters that users set for their Binance Futures account. Firstly, placing or canceling an order of the symbol in the grid transaction can terminate the grid. Secondly, the grid will expire when the user has set a stop price and the market price reaches the stop-loss price of the set Grid Trading strategy.

8. Why doesn’t the stop-limit order proceed even if the stop-price order has been triggered?

Stop-price orders consist of two prices: stop-price and limit-price. When the stop price is reached, the limit order with the present limit price will be placed into the market. However, the limit order may still not be carried out. Because the limit order will be executed when the market price is at or better than the limit price, the limit order will not be executed if the market price is lower than the limit price after the stop-limit order is triggered.

9. Why does the liquidation happen even if I have an unrealized profit?

The liquidation is triggered when the margin balance = the balance in the wallet + the total loss and profit < the maintenance margin.

All positions under Cross Margin mode share the same margin balance. As a result, the total number of unrealized losses causes the margin balance to be lower than the maintenance margin, it will trigger a liquidation in Cross Margin mode even with portable positions.

10. If my isolated position goes bankrupt on Testnet, how do I clear the negative balance?

On Binance Futures Testnet, if your isolated positions go bankrupt, you need clear the negative balance by adding margin. If you have enough assets in your account, you just need to press the margin adjustment button and add the margin. If you don’t have enough assets in your account, you’ll have to add assets first.

Is Binance Futures safe and should it be used?

As part of Binance’s ecosystem, Binance Futures has a high reputation. For those who need to use leverage to trade, Binance Futures is the right choice.

However, always remember: Financial leverage is a double-edged sword. Always be very careful with your property. See more reasons to avoid futures trading.

This article shares with you about Binance Futures and related aspects. It will help you better understand the cryptocurrency market. Besides profitability, the risk of Binance Futures trading is very high, so always do you own research and don’t forget to follow WikiBinance for knowledge and skills entering the cryptocurrency market.