What is Binance Liquidity Farming?

Binance Liquidity Farming is the deposit of coins into a liquidity pool. Through decentralized exchanges, senders receive the reward from trading fees on the exchange.

What kind of products does Binance Liquidity Farming support?

Liquidity Farming has two types of products: Stable and Innovative.

Stable makes transaction and valuates between two stable, peer-to-peer tokens while providing a trading experience with a low slippage. Innovative is based on a system model that generates an automatic market with a constant mean value for two digital tokens to make transactions and pricing.

Exchange rate/token price fluctuations affect the prices of the two tokens in the pool. Meanwhile, the rewards for liquidity providers of Innovative fluctuate more than Stable.

Terms of Binance Liquidity Farming

- Current pool size: The pair’s composition in the current pool. When adding assets, you will also add at this proportion.

- Add: Provides liquidity for the liquidity pool.

- Remove: Withdraw tokens from the liquidity pool.

- Price: The swap price between the tokens of the pair traded in the pool. The final price is determined by a formula based on the proportion of the trading pair in the liquidity pool.

- Portion: The expected part you’ll get in the pool after adding liquidity.

- Portion of the pool: The expected share you’ll get in the pool after adding liquidity.

- Slippage: The estimated percentage by which the swap’s final executed price differs from the current price because of the trading amount.

- Total yield: The estimated annual yield that users can receive when providing liquidity.

- My Portion: When you contribute liquidity to the liquidity pool, a portion you receive will be different from the single token you add. The portion consists of two digital tokens. Based on the current pool size, the amount of the two digital tokens will vary in real-time.

- Total Yield: The latest reference rate of return for the trading pair.

- Portion amount: The number of tokens in acquired portion.

- Portion value: The total value of the portion acquired after assets have been added.

- Pool Portion Composition: Your current component portion. Based on the current pool size, the amount of the two tokens will vary in real-time.

- Cost per Portion: Denominated in USD, based on the cost per portion when liquidity is added.

- Portion Value PNL: Calculated by the current portion value minus the total cost of the portion, denominated in USD. A variety of factors affect portion value, including exchange rates, token price fluctuations, and impermanent losses, which can result in positive or negative returns.

- Earnings: Includes income from Liquidity Farming fees and liquidity rewards, calculated in USD.

Profit calculation formula

Total yield

Total yield= 365* (rewards allocated in the last 24 hours + transaction fee rewards in the last 24 hours) / total pool value in the last 24 hours

Portion value

- Portion value = The number of two tokens in the portion composition * real-time exchange rates, calculated in USD.

- Example:

User portion value = 100 USDT + 50 DAI

Real-time exchange rate: 1 USDT = 1,005 USD;

1 DAI = 1.01 USD

Portion value = 100 USDT * 1,005 + 50 DAI * 1.01 = 151 USD

Is Binance Liquidity Farming a guaranteed investment?

Binance Liquidity Farming is not a guaranteed investment. The cause of the loss is:

- Fluctuations in token prices, or fiat currency exchange rates, will have an impact on portion value.

- Because of excessive slippage, portion value will be affected and lost when a large number of tokens are added or redeemed.

- Frequently adding or redeeming tokens.

You can do more research on less risky products at Binance Earn

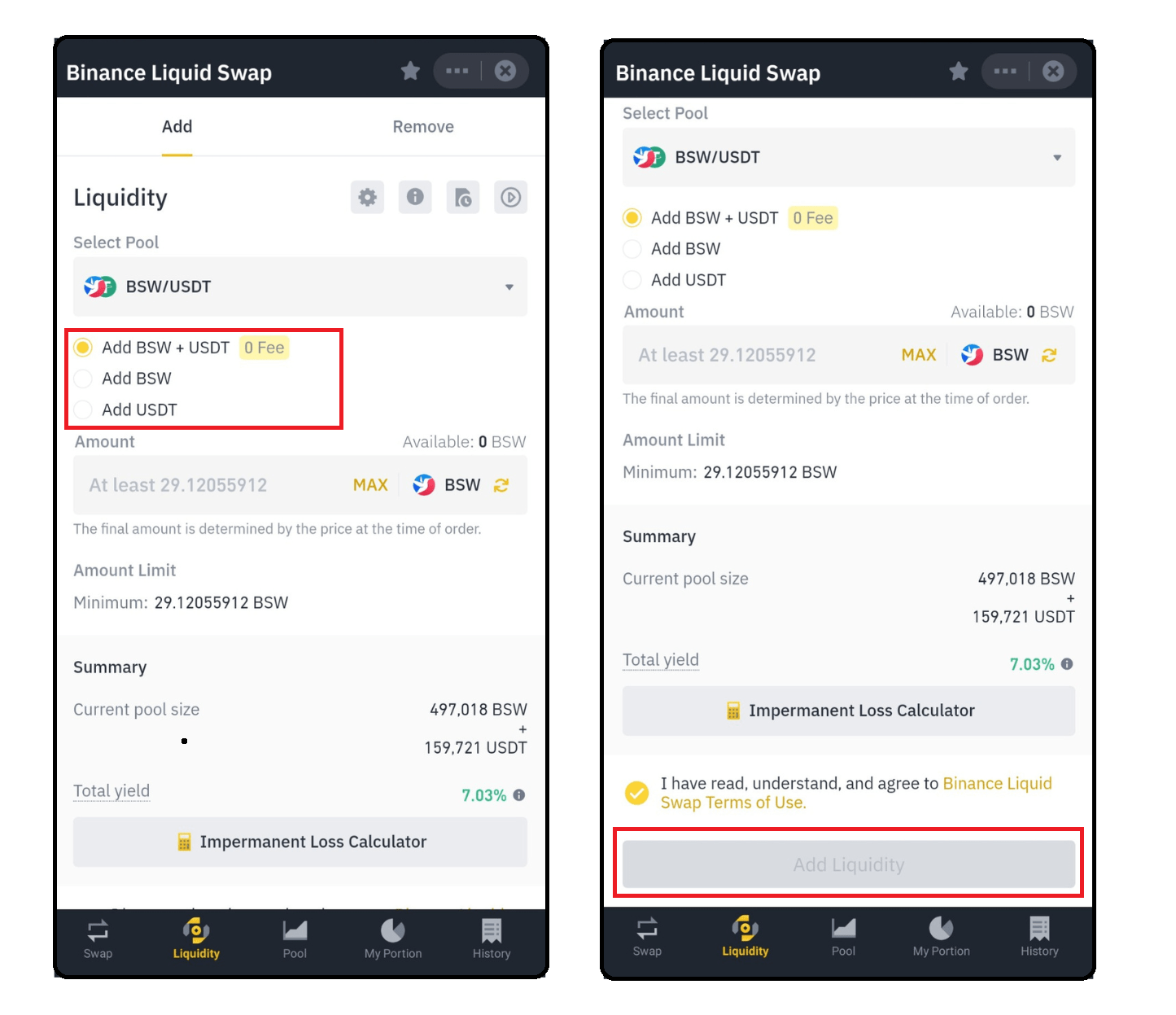

How to add or remove liquidity?

How to add liquidity

- Add two tokens – The system will automatically display the number of tokens to add based on the current size of the pool.

- Add a token – Based on the current portion composition ratio in the pool, the system will swap the token you added into the other token of your chosen pair. During the conversion, transaction fees will be incurred, and large transactions may result in increased slippage and loss.

How to remove liquidity

- Remove two tokens: The system will return the two tokens to your Spot Wallet based on the pool portion and composition.

- Withdraw a token. – Based on the current portion composition ratio in the pool, the system will swap the token you added into the other token of your chosen pair. During the conversion, transaction fees will be incurred, and large transactions may result in increased slippage and loss. When the slippage becomes too great, the system sends an alert on the page.

How to add Binance Liquidity Farming

Step 1: On the home page of the Binance app, click [Earn], select [Liquidity Farming]

![Click [Earn], select [Liquidity Farming]](https://wikibinance.com/wp-content/uploads/2022/06/Chon-Liquidity-Farming.png)