P2P (peer-to-peer) is the world’s leading cryptocurrency trading platform in which the role of all users is the same. Investors can buy and sell popular cryptocurrencies on Binance P2P. The transaction takes place between millions of investors around the world with more than 150 different payment methods.

Due to the strong development and diverse connection, P2P is considered a lucrative address where bad actors impersonate Binance staff to gain your trust and steal information from you. They take advantage of the gullibility, little experience of new investors entering the market. Even seasoned investors, if not alert enough, can still become completely victims.

The article below introduces common crypto imposter scams and give you solutions to avoid scams on Binance P2P.

Fake Receipt Scams

The scammer is the buyer of the coin from investors. He will mark “paid” and send a fake transaction receipt after the order is matched. It could be a bank receipt or e-wallet that is modified information that matches previously agreed transactions.

The scammer will then convince the investor who successfully transferred the coins and asked to unlock it for many convincing reasons: the assets transferred will definitely go to the account, you will receive the currency as soon as press the confirmation button. If the investor negligently fails to check the account and presses the confirmation to release the asset, the scammer has won the assets and will move to another wallet or sell the asset away immediately.

Therefore, investors need to check their bank account balance regularly. When the banking system has not received money, absolutely do not release assets.

If you receive a suspicious money transfer receipt (false information, non-standard format, unclear image…) then it is highly likely to be a fraudulent receipt. When you receive a receipt of this type and the account does not record the balance, immediately click the complaint for Binance P2P customer support to intervene.

Transfer Scams

Similar to the above trick, scammers also impersonate customers who buy cryptocurrencies from investors through P2P trading. They will place a buy order from the ad for a certain amount, then pay only a small amount of money to the investor.

For example, the scammer placed a buy order for 29,999,999 VND, but he only paid 29,999 VND to the seller.

When the investor does not check the bank account thoroughly when receiving the balance fluctuation notice, believe that he has received enough money and release the assets, the scammer will achieve his purpose.

To avoid the unfortunate happening, the investors need to thoroughly check his bank account, as the transaction amount and the amount of the transfer look the same. If you encounter the same situation as shown above, immediately make the complaint for Binance P2P Customer Support to intervene.

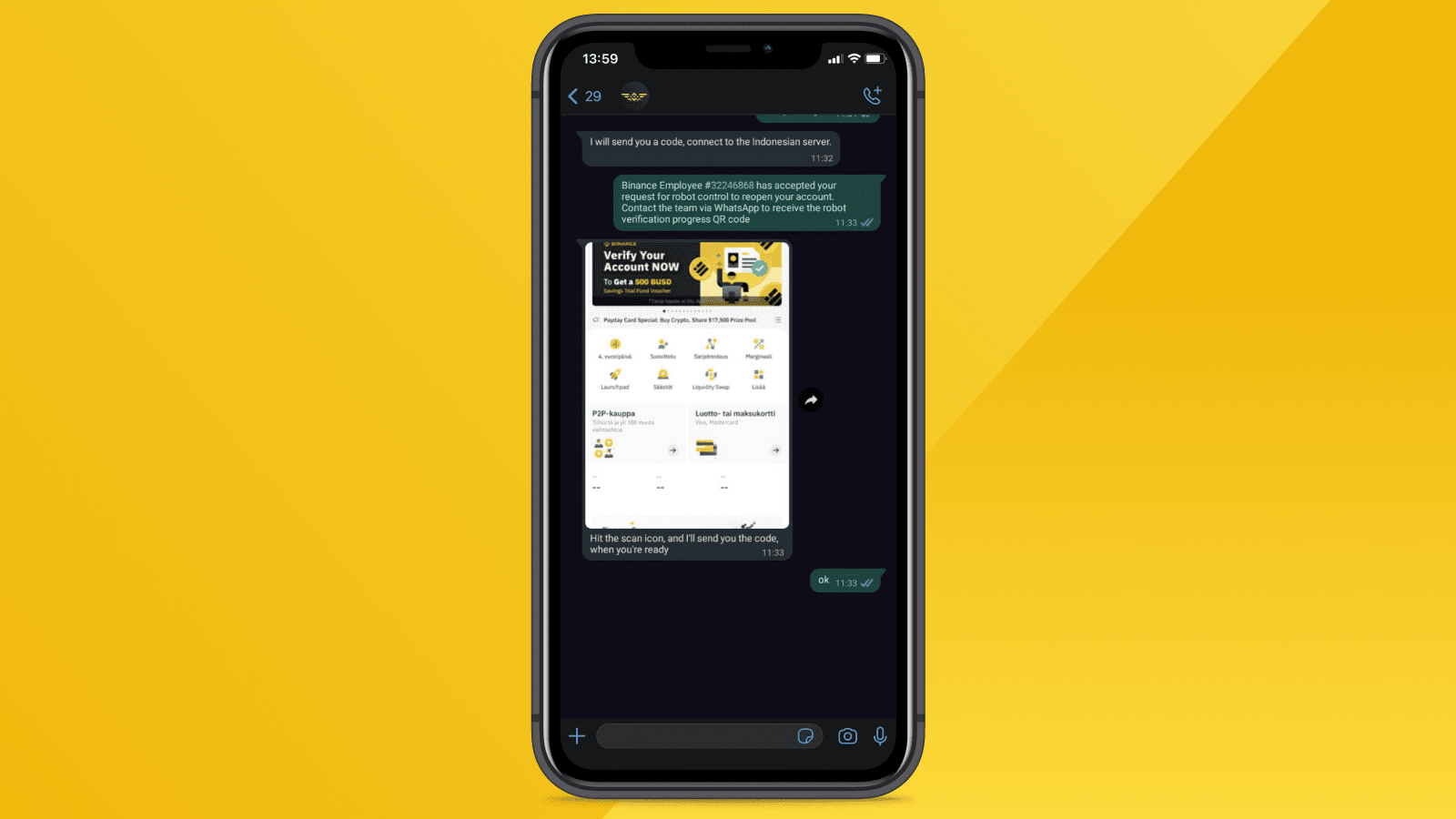

Verification Code Scams

This is a more sophisticated trick when the scammer aims to take control of the investor’s Binance account and transfer all the assets to another wallet or sell on Binance P2P.

The scammers will often impersonate Binance staff or Customer Support call center by using an international phone number to call the victims, offer to make friends on Zalo or Viber, and offer assistance in resolving complaint issues.

The scammers will then chat with the victims, persuade them to drop the claim and agree to confirm the asset release for the P2P transactions that are in dispute. The reason he gave was that the assets would be transferred to the account as soon as the investor released the assets.

In other cases, the scammer will suggest resetting the Binance account and asking the victim to log out of the account, scan the QR code, and provide a verification code.

If investors are gullible, they will be scammed into gaining access to their Binance account. At this time, assets will be withdrawn by the scammer to another wallet or sold on P2P. Therefore, investors should never scan any QR codes that are not provided on Binance’s official website or application, especially through social networking platforms.

Investors absolutely do not provide account verification codes for Binance’s staff. These codes are sent separately to the user to confirm transactions.

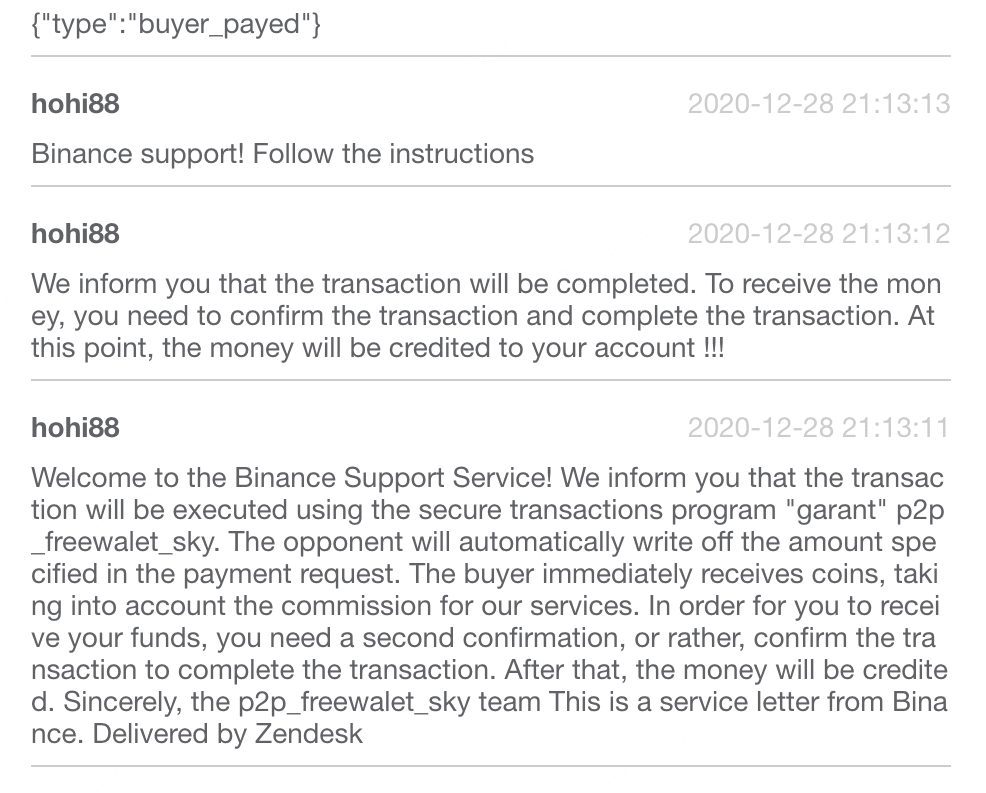

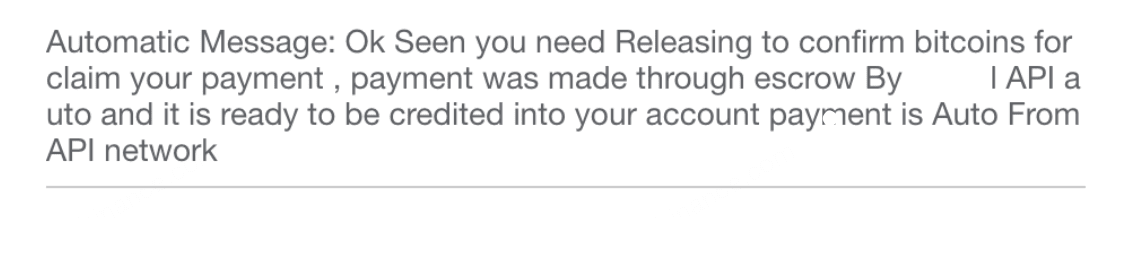

Fake automated payment system

The scammers are the buyers and tries to convince the seller to release the assets before they receive the payment. They will impersonate Binance or some automated payment systems and send a message to the seller that they must release the assets to receive the payment.

In fact, Binance P2P does not offer an automated payment system, every transaction is peer-to-peer, between buyers and sellers.

In other cases, the scammer claims to be an automated trading system and convinces the seller to release the asset and the money will be paid automatically from the escrow service.

Scams are usually carried out by international scammers, the content is often unreliable so most investors will not execute transactions.

However, these scammers will succeed, if less experienced investors believe that the notice was actually sent from Binance’s customer service and followed the instructions without checking the bank account first. Once the scammers reach their goal, the investors are not able to lock up their assets. When the victim realizes the scam, the scammers have withdrawn all assets to the wallets off the exchange.

Therefore, the investors also need to check the bank account to confirm the payment from the buyer before pressing to release the assets. Similar to the above cases, when investors are urged to release assets without receiving payment, the buyers constantly commit that money will transfer to the account immediately after unlocking the cryptocurrency, investors should immediately make a complaint to be supported by CS staff.

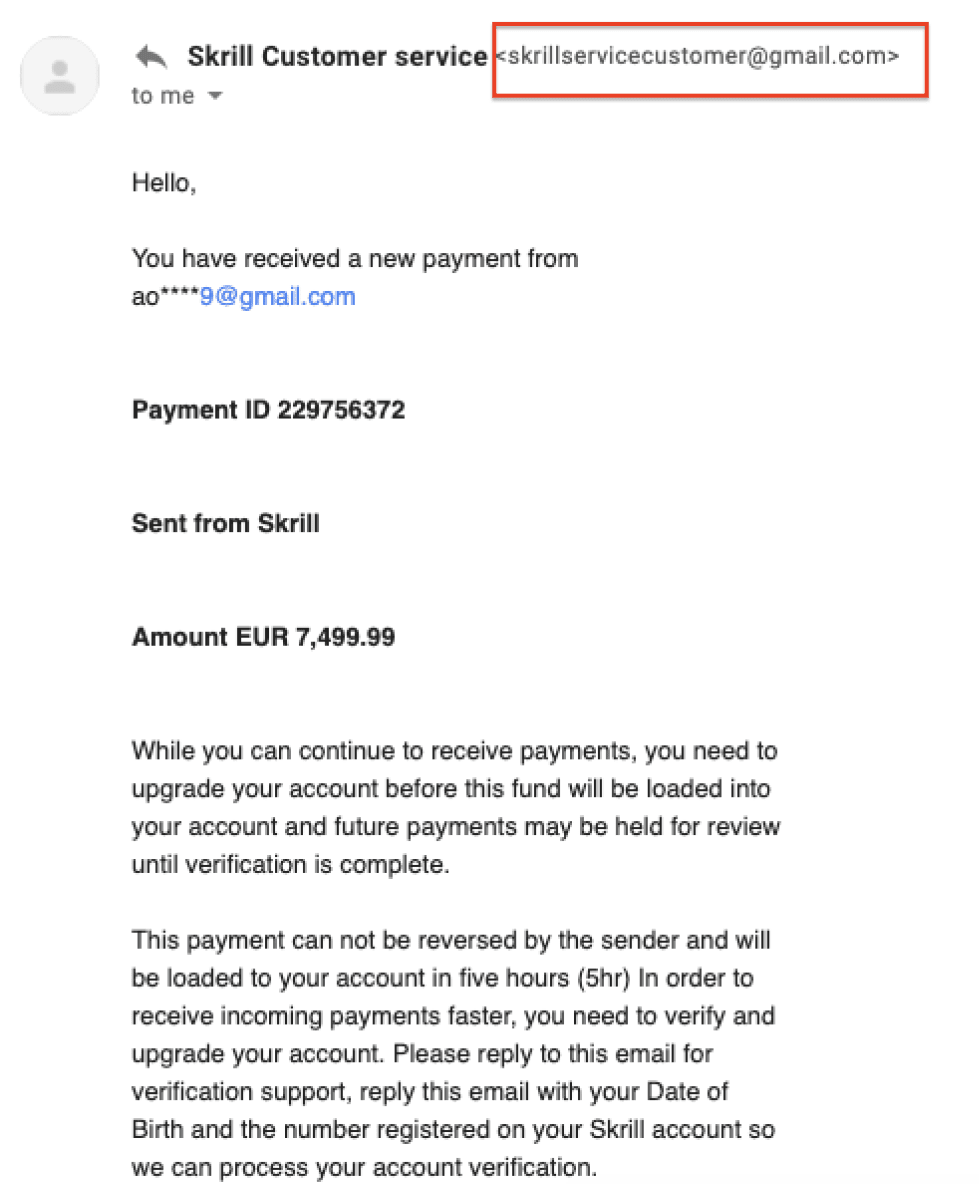

International payment scams

PayPal and Skrill are the most popular payment platforms in the world, used by many Vietnamese living abroad for international payments. Because of its convenience and widespread coverage, scammers also choose this platform as a payment method when performing P2P transaction scams.

The scammers will impersonate the buyers of the cryptocurrency to forge the payment confirmation email and send this fake bill to the victims’ email that requires them to confirm that the payment has been made and the money is being transferred to the account.

In the example above, the payment method used is Skrill. The scammers created a fake email that investors had successfully transferred money. The main purpose is to mislead the victims that they have been paid and require them to unlock the cryptocurrency. In fact, if you look closely at the domain name of this email, investors can easily realize that this is not Skrill’s official email account, this is a regular Gmail that everyone can create for free.

Similar to the above cases, the investors will lose the asset if they confirms to unlock his cryptocurrency and they believe that the asset is already transferred to the account of the payment platform. By the time they realized the scam and reported, it was highly likely that the assets had been withdrawn to wallets outside Binance.

To protect their assets, investors need to thoroughly learn the payment method, email form and confirmation email address. Notifications from these platforms are sent from official emails (with the company’s domain name).

Investors absolutely must not release their cryptocurrencies without receiving money on international payment platforms. If there are any problems, the investor needs to be calm, ask for more time from the partner and contact with customer service directly of these platforms for support.

If these are fake payment emails, the investor should immediately notify Binance’s customer service to be verified and cancelled the transaction if necessary.

If the investor receives a payment from a third party, the transferor’s information does not match the trader’s information, immediately request a refund and cancel the transaction. This is a measure to help investors limit the risk of being collected by these international payment platforms.

If receiving a complaint email about the amount received on international payment platforms, the investor should provide related evidence to the transaction as soon as possible to avoid the response beyond the permitted time.

When trading on the international market (USD/EUR), investors should look for reputable P2P merchant or traders with high trading volume and completion rate (>90%)

Conclusion

The cryptocurrency market is growing and peer-to-peer trading is considered as an effective measure to help optimize transactions between buyers and sellers. This is also a good opportunity for scammers to perform sophisticated tricks to usurp the assets of investors, especially new investors with little trading experience. To minimize the risk of losing assets, this article lists common cases of scams in P2P trading and gives some advice to investors as follows:

- Raise your vigilance against unusual trading ads, e.g. buy ads that have a much higher price than the general level of the market;

- Be wary of users who have never had a successful transaction, or a very low transaction completion rate;

- Go to reputable traders (users with gold ticks next to nicknames) for the best service;

- If you’re a seller, always check your bank account to make sure you’ve received the full amount before releasing the property;

- Absolutely do not communicate with people claiming to be Binance employees or support departments on social networks (including reputable social networks);

- Binance currently does not have a call center or hotline to support users but only communicates on the official website and application, so absolutely do not work with cases of calling referrals as Binance employees and offering help.