NFT floor price is the lowest priced in a collection. Each NFT is unique and has different attributes that make it rare or often sought after. These attributes also make it difficult to determine the exact value of the NFT. While tangible assets such as artwork or physical collectibles such as cards have often determined their value, collectors and investors looking to buy NFT may have difficulty deciding whether NFT is worth their money. This is when NFT indices, such as floor price, come into play.

What is the NFT floor price?

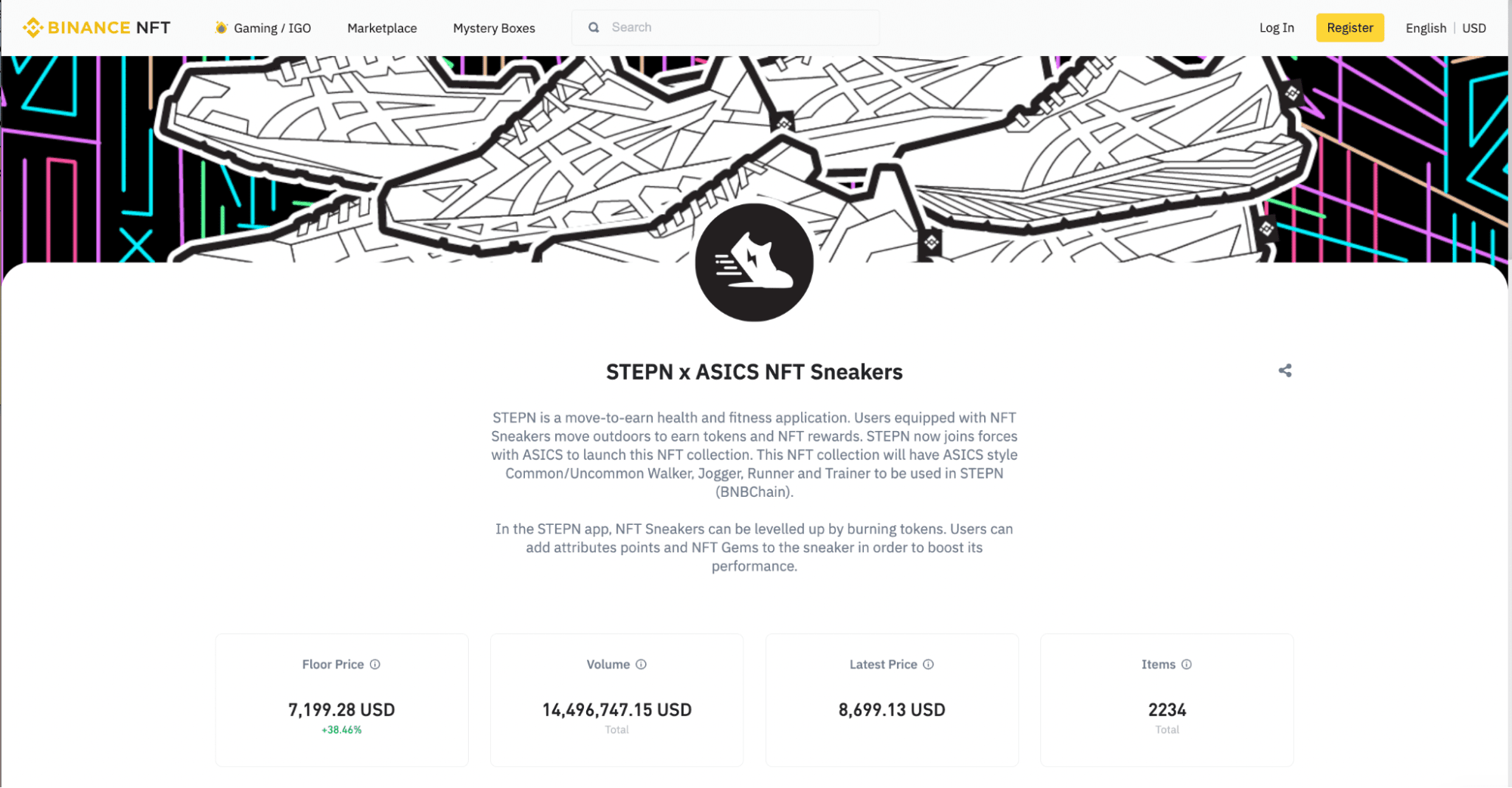

NFT floor price is the lowest priced in a collection and is one of the most widely used data collection tools for project evaluation. For example, the floor price of STEPN x ASICS NFT Sneaker at the moment is $14,767.70. This means that if you want to buy a STEPN x ASICS NFT Sneaker, then $14,767.70 is the cheapest option you have to have in the project.

How is the floor price calculated?

People who own an NFT in a floor price setting project – the more popular an NFT project is, the higher the floor price. The sudden drop in the NFT floor price of the project could indicate that an NFT project is losing traction.

What does sweeping the floor mean in the NFT space?

“Sweeping the floor” refers to the purchase of digital assets in large quantities, namely those that are in the collection. In the NFT space, “floor scanning” can be applied to both project owners and buyers. If the project owner sweeps the floor, they will buy all their NFT at the floor price. When buyers scan the floor, it means they have purchased all the NFT available in the project or many of them. Both of these indicate a potential manipulation of the NFT floor price.

How to avoid NFT floor price manipulation

While buying a floor price can be a solid starting strategy for newcomers to the NFT project, floor price can be manipulated. It’s not uncommon for newly minted NFT projects with high potential to be strongly purchased by a person or a team to artificially drive demand. Once completed, buyers(s) can sell these newly acquired NFT’s at a higher floor price – similar to how speculators buy event tickets and resell them at a higher price.

Likewise, take note of projects that don’t have important communities where NFT has been ‘wiped out’. In such cases, the project may have arranged a sweep to increase the floor price and overall value of the collection. To avoid falling into a market price being manipulated by a sweep, always review the trading history of the NFT you want to buy and DYOR to assess the long-term value of the project.

You should join their Discord and Telegram groups; see if their community is legal, such as those who follow them on social media, to support decision-making on NFT investments.

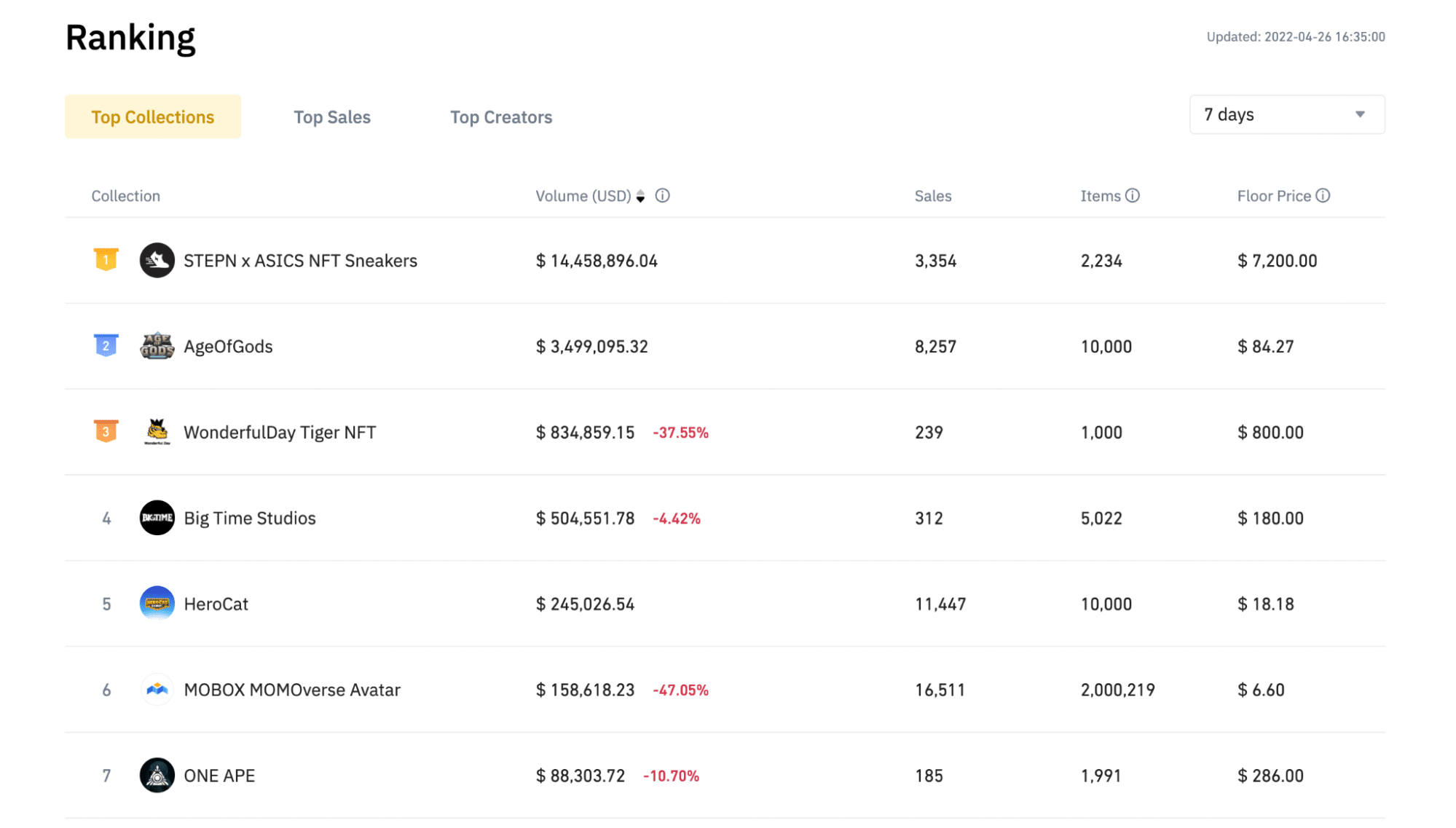

Where can you check the NFT & history floor price chart on Binance NFT?

You can easily locate the floor price of an NFT collection on Binance NFT Marketplace in two ways. One way is to go to the Top Collections under the Charts, where you can see a list of trending NFT collections and their floor prices. If you’re looking for the floor price of a particular collection, simply enter the name of the NFT collection in the search bar and you’ll see the NFT floor price clearly displayed at the top. In addition, you can also see direct changes in floor price in the Binance NFT market, which is represented by a percentage change.

Closing thought

Market forces primarily determine the value of NFT, and it is impossible to predict the future of the NFT space with certainty. However, you can increase your chances of success by using metrics such as floor price and thorough due diligence to guide your buying strategy.

>>> Related: What is Binance? Binance registration guide