What is grid trading?

Grid trading is the automatic purchase and sale of Futures contracts. This tool is created for the purpose of placing orders in the market within the configured price range in predetermined period of time.

Grid trading is suitable for volatile and sideways markets, the price fluctuates within a certain range. This tool allows investors to earn profits on even the smallest price changes.

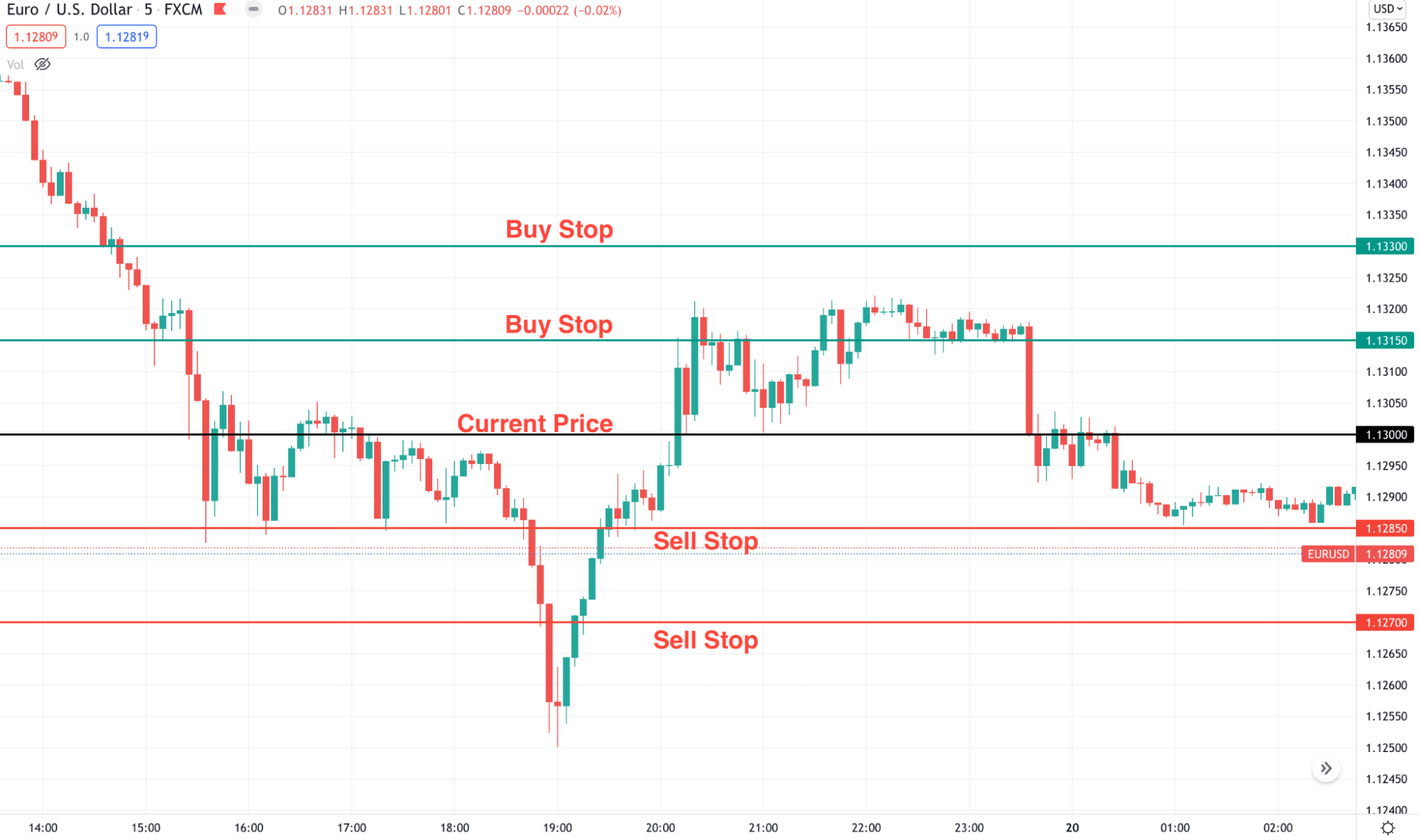

To put it more simply, Grid Trading is an order placed above and below a set price. It forms a network of orders with ascending and descending prices. This order takes advantage of price volatility to make a profit for investors.

What is a Long/Short Grid?

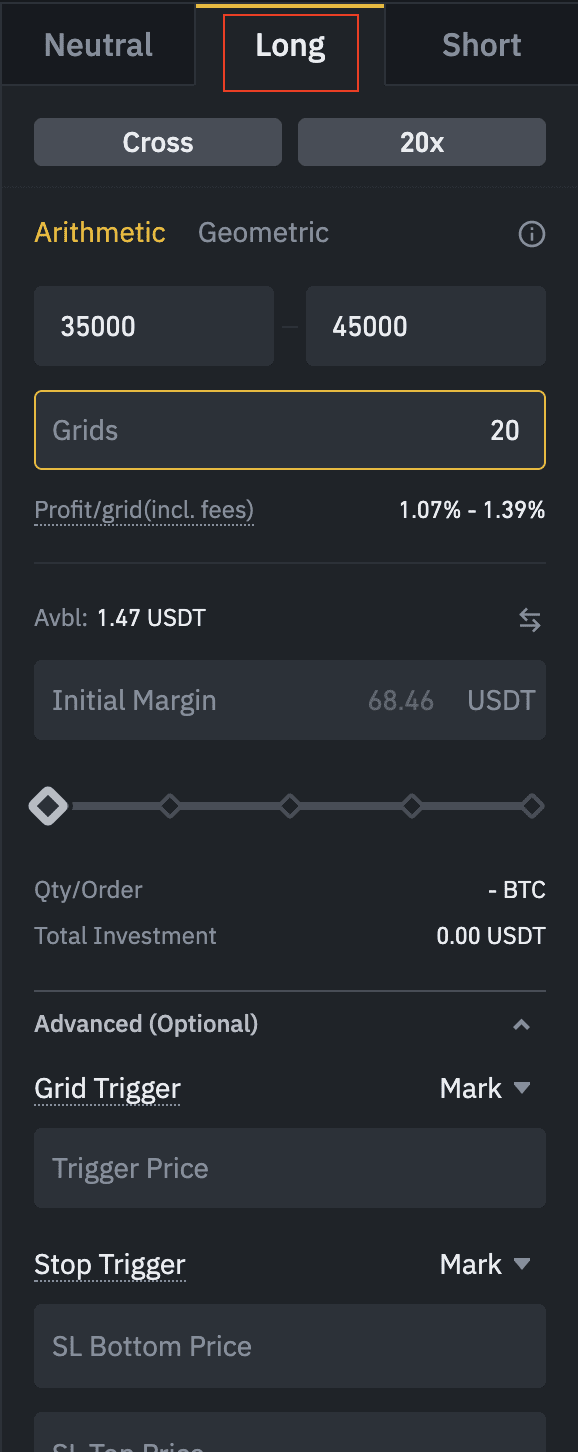

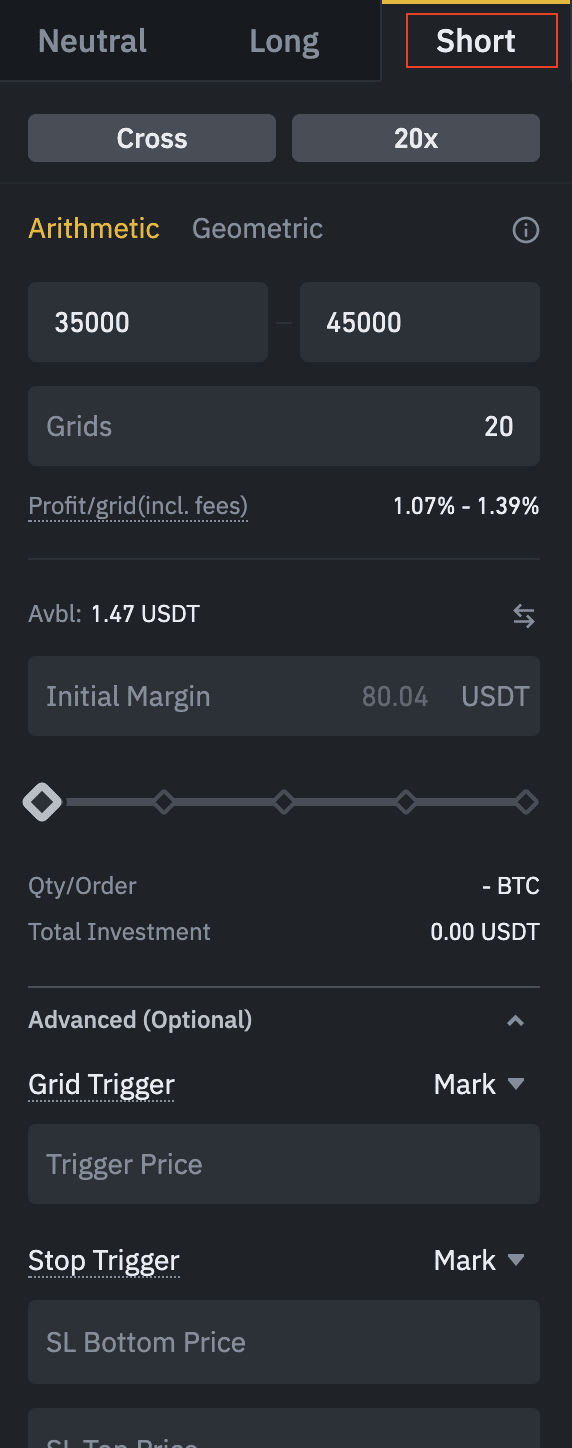

Long/Short grid (or buy/sell grid) is a trading strategy that users are able to trade according to market trends in the Grid Trading system. The investor is required to open an initial investment position (Long or Short) and place a buy-limit and sell-limit at predetermined intervals to take advantage of market volatility and price range.

For instance, the investor opens the initial Long position for the BTCUSDT contract and anticipates BTC will increase in price. At the same time, that investor placed a sell order at $1000 higher than the market price for this contract. These settings allow investors to trade in the Grid Trading system while following the underlying trend.

How to set up Long/Short Grid Trading on Binance

Currently, Grid Trading is executing buy-limit and sell-limit orders according to the system based on the user’s parameters. Here, investors can build the first Grid Trading strategy.

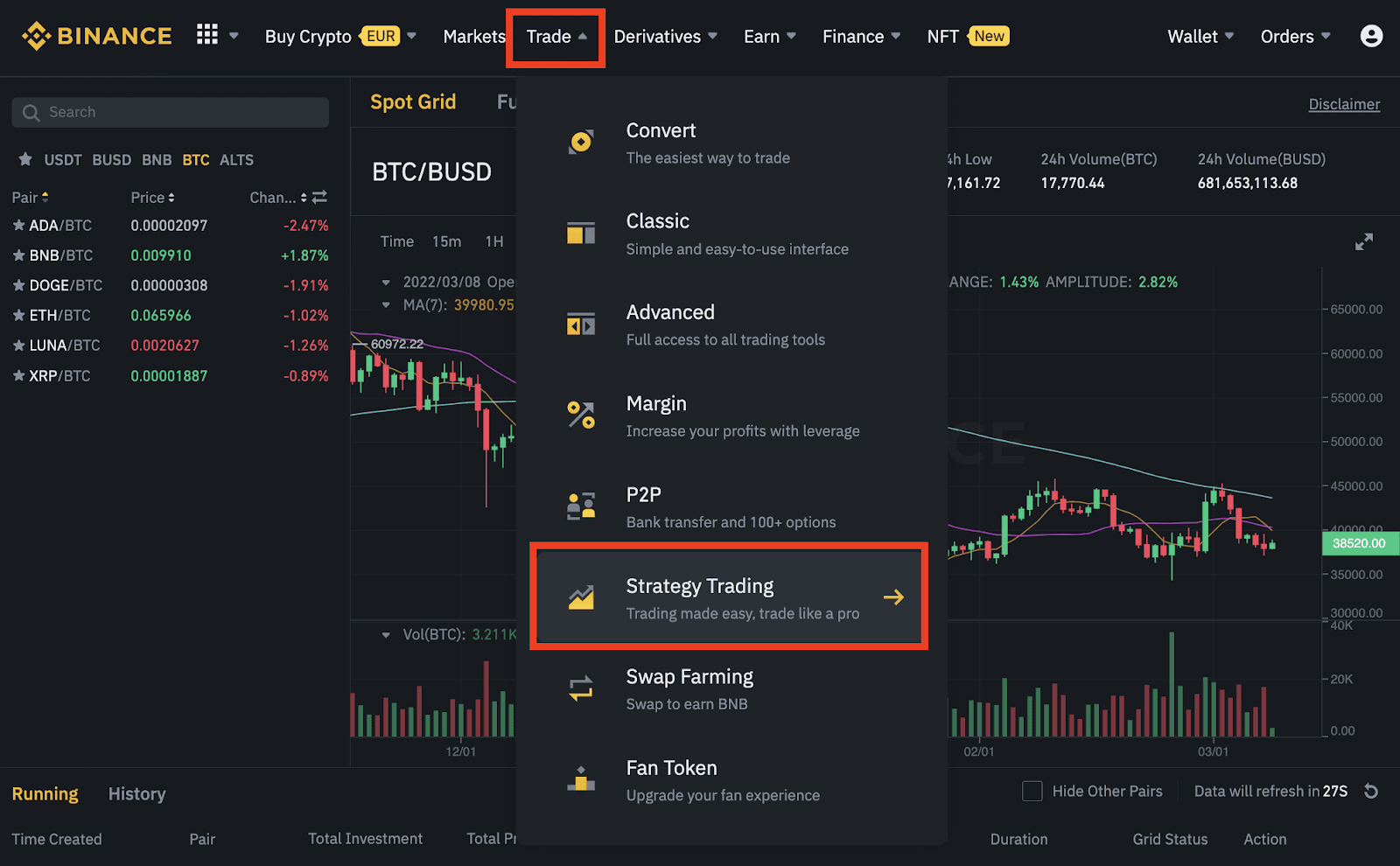

Step 1: Access to the Futures Trading and press [Grid Trading] on the top menu bar then select the contract that will execute the trade.

![Press [Grid Trading] on the top menu bar then select the contrac](https://wikibinance.com/wp-content/uploads/2022/05/372d55313fe31b87c104d990b9a3e497.png)

- The upper and lower boundaries of the price range;

- The amount of orders within the set price range;

- The width between each Grid order;

- Initial margin.

Note, if the current market price is greater than the grid trading area, the strategy will start at zero.

Step 3: Determine the initial margin value of the position.

The system will calculate the initial margin value based on the number of grids, the level of leverage, and the strategic value range. The thickness of the grid is proportional to the initial margin value.

Note, the nominal value of each grid order must be greater than the minimum required. To ensure this value, the investor must adjust the number of grids (decreased) or the initial margin value (increased).

When the initial margin value is less than the minimum required level, the investor will receive a notification of the requirement to meet that value to activate the new strategy. The investor must ensure that the balance and margin level is higher than the initial margin value. Otherwise, the strategy will be liquidated.

Step 4: Tap [Create] to set up the grid order.

Set up advanced Grid Trading

To help investors manage their positions effectively and minimize risks, Grid Trading has developed advanced functions – trigger price. This is the predetermined price for the system to activate the grid transaction at that price. At that time, the investor can set the order when the system will operate, as long as the market conditions meet the criteria set initially.

When the grid trading is triggered, the system will divide the assets into multiple grid levels according to the parameters that the investor has set, and set pending orders for each price level.

The buy order will be executed when the price falls, the sell order will be placed immediately when the price rises. Buy orders can be placed alternately, as soon as the sell order is executed that the asset price increases. This helps investors to always trade at the most favorable times and make a profit in volatile market conditions.

Besides, to ensure the position, investors can place stop-loss order. The system will close the entire grid position that was initially established when the asset price goes beyond the stop-loss range. This is the best solution to maintain the position of investors in unfavorable market conditions.

>>> Related: How to place Stop-Loss and Take Profit orders on Binance

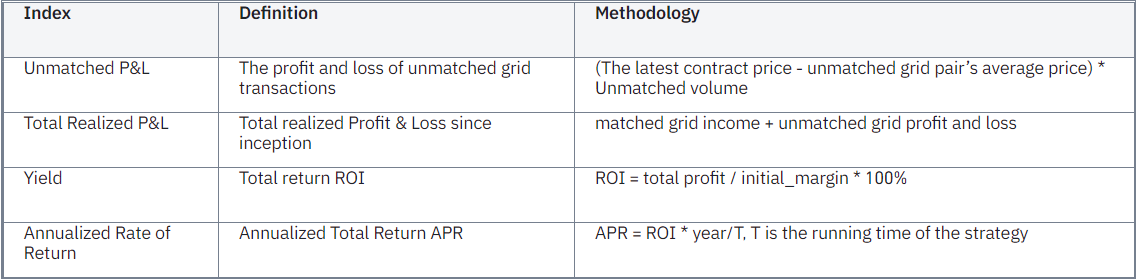

Calculate profit and loss of Long/Short Grid

This is the job of looking at matching and mismatched profits. The completed transactions are the matches and vice versa. Matched trading means that every position in the grid strategy has been matched to the correspondingly matched orders. The calculation of profit and loss is aggregated in the following table:

How to calculate the total profitability of Grid Trading

Realized profits & unrealized P&L methodology

Total Profit = Net Realized Profit + Unrealized P&L

- Calculated net realized profit: This figure is calculated by the gross realized profit minus total fee expenses of all the completed orders in Grid Trading.

- Unrecorded P&L: calculated based on the difference between the last price and the entry price of open positions.

Unmatched P&L and Matched Profits methodology:

Total profit = Matched profit + Unmatched PNL

- Profits: Total profit of matched orders

- Unmatched profits: Based on the difference between the last price and the average price of the orders that have not yet matched.

The avg. filled price of unmatched orders = (∑Total amount of unmatched orders) / (∑Quantity of unmatched orders)

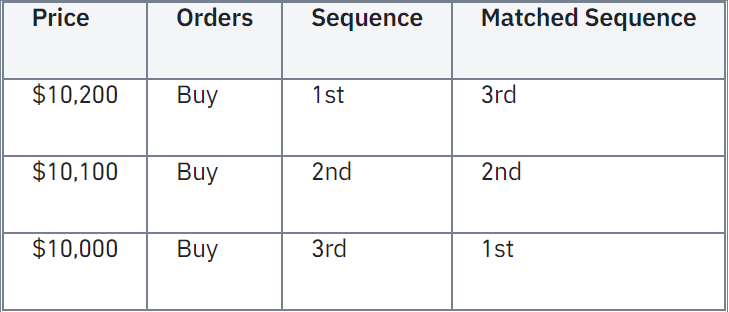

How are positions matched?

The position is matched by the FILO (First In Last Out) method, i.e. the first filled orders will be matched later. For instance:

The last buy order for $10,000 will be matched with a price of $10,100. The remaining orders will be matched at the corresponding higher price.

Conclusion

In short, Grid Trading is an easy-to-use trading method and does not require high investment technique or the ability to predict the market. Since the calculations are automatically processed by the system, this method is especially suitable for new investors entering the market.

However, in order to earn high profits, investors need knowledge, experience and the ability to combine a variety of methods in trading.

>>> Related: Guide to sign up for Binance account update 2022