Binance Option, commonly known as American-style options, is an optimized version of the traditional options contract. It was developed to improve the user experience and simplify barriers to engagement for individual users. As the market grew and became more complex, Vol Option is considered as a feature aimed at supporting investors in transactions, making cryptocurrency investments more effective.

What is Vol Option?

Vol Option is often referred to as “Straddle”. This is a neutral options strategy that includes simultaneously buying both the put options and call option of a base asset class, with the same strike price and expiration date. That means the system can make two transactions at the same time.

Buying Vol Option can help investors keep a close eye on market volatility, no matter which way the market goes. This makes it possible for the investor to earn unlimited profit, as long as the underlying asset fluctuates away from the break-even point and the maximum loss for the option is considered as the premium that investors have to pay.

However, premium cost of Vol Option are relatively high compared to a call or a put option. Investors may deal with the risk of losing the premium in case the market does not fluctuate much.

Vol Premium = (Call Premium + Put Premium) * 0.95

*5% Discount

Currently, Vol Option has been updated by Binance on the mobile app. Users can update the latest version to experience. Vol Option is compatible with iOS App 2.20.0 or Android App 1.31.0

How to buy Vol Option on Binance

As mentioned above, investors can buy Vol Option to make a profit in significantly volatile market conditions.

Step 1:

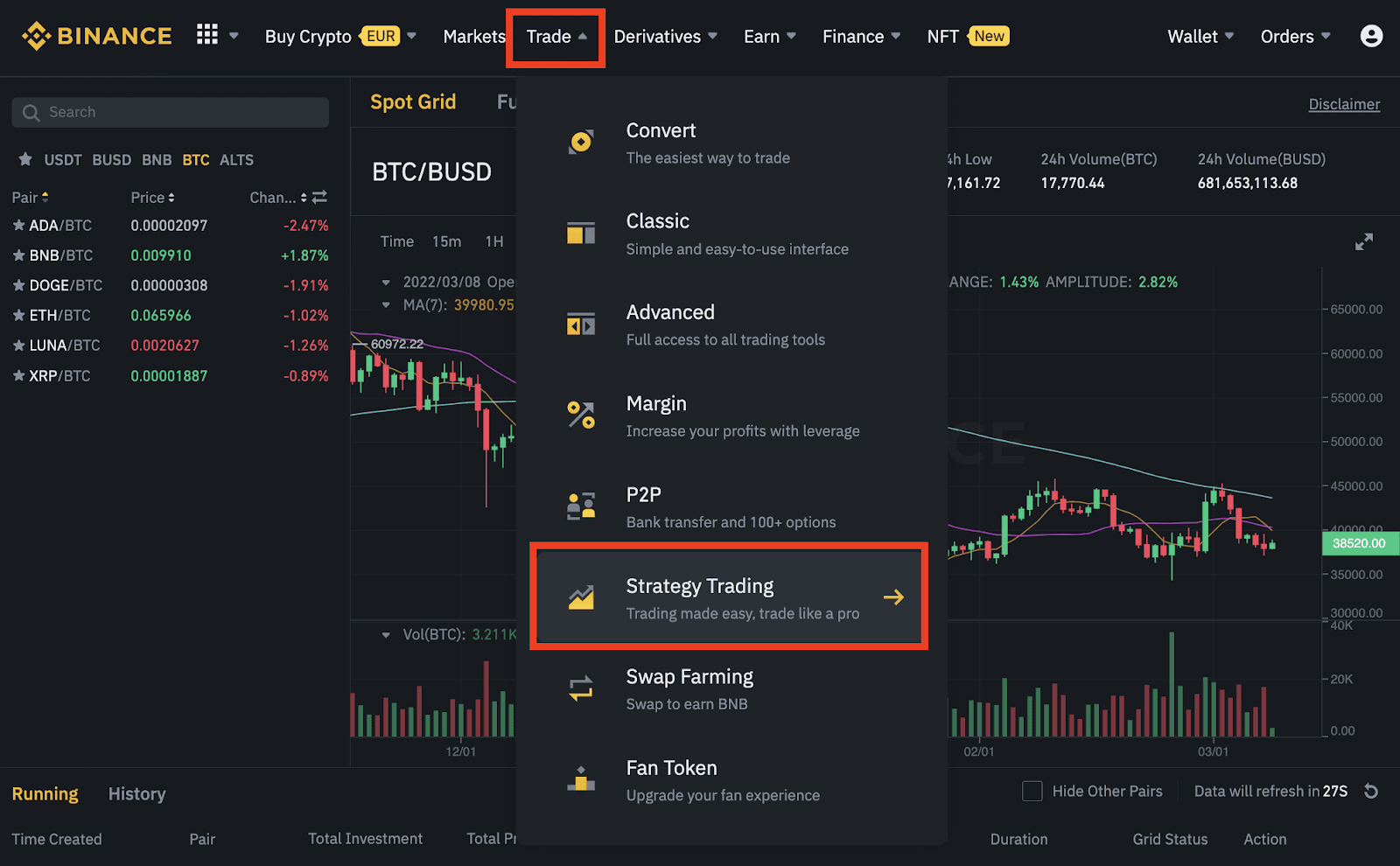

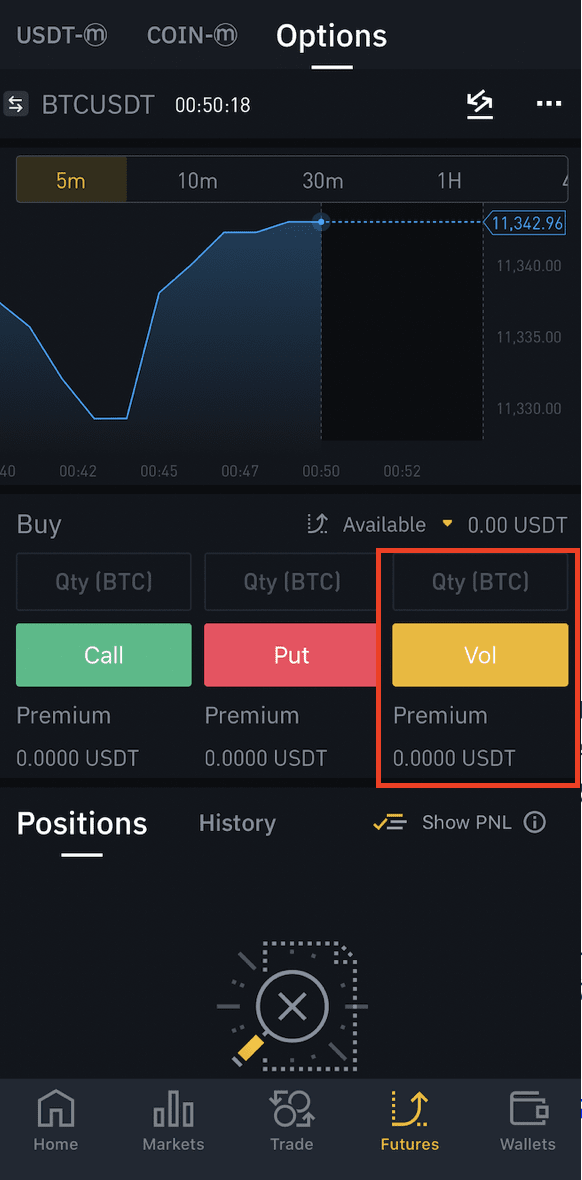

- Log in to Binance, select [Futures contracts] → [Options];

- Select option maturity time (5 minutes, 10 minutes, 30 minutes, 1 hour, 4 hours, 6 hours, 12 hours, 1 day);

- Enter the number of orders and click [Vol].

![Enter the number of orders and click [Vol]](https://wikibinance.com/wp-content/uploads/2022/05/Vol-Option.png)

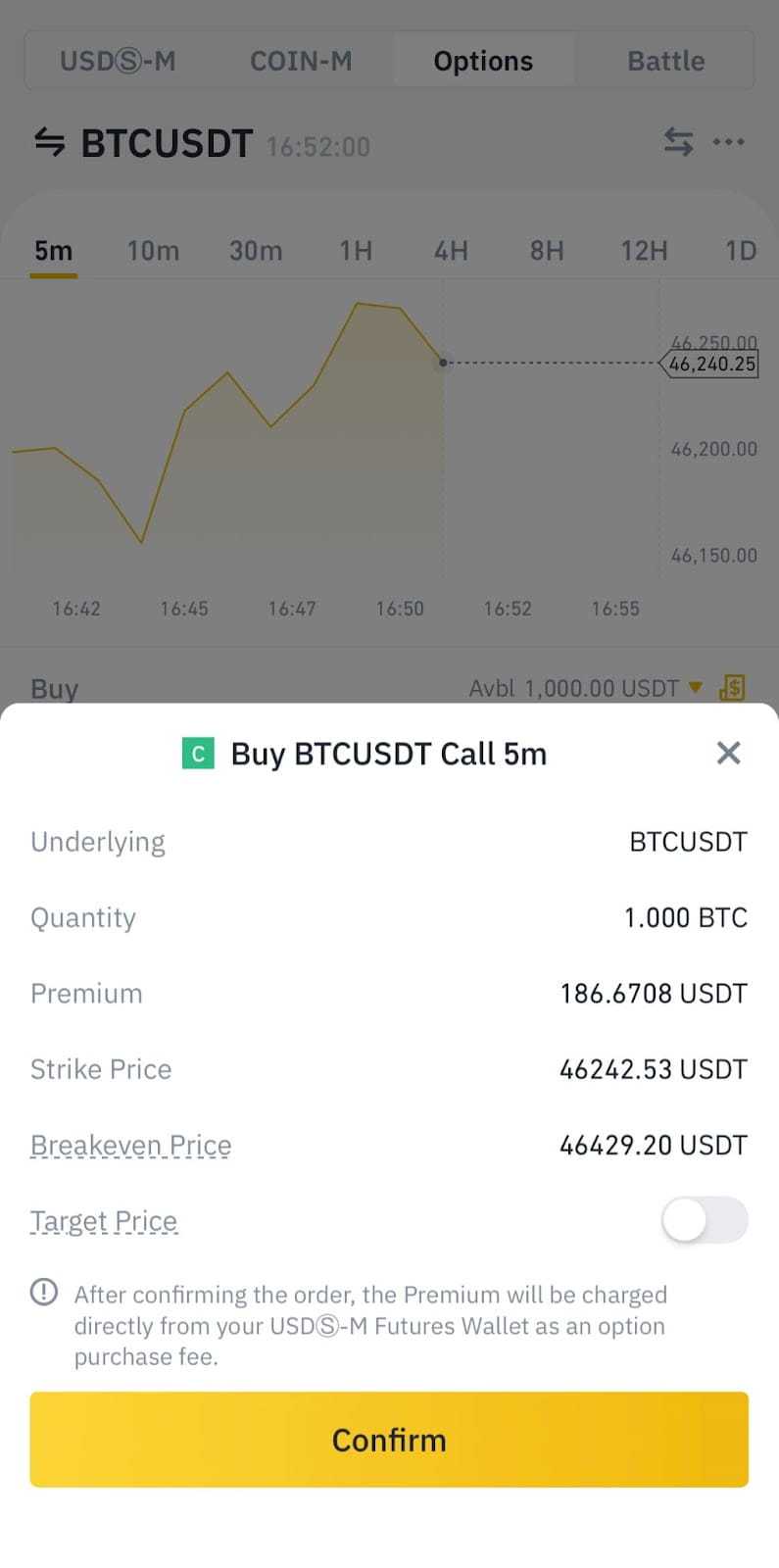

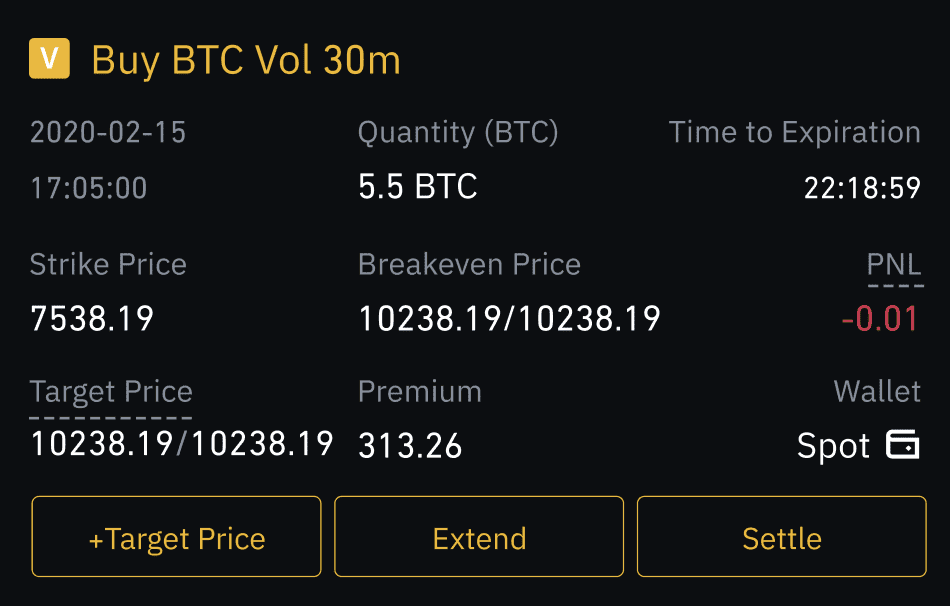

- Check the order details: the contract name, quantity, the strike price, the premium to pay (according to the time taken after entering the quantity), break-even price. Then click on [Confirm].

- Note, since investors are buying both a call option and a put option, Vol Option has two breakeven prices.

Breakeven Price of Call Option = Strike Price + (Premium/Quantity)

Breakeven Price of Put Option = Strike Price – (Premium/Quantity)

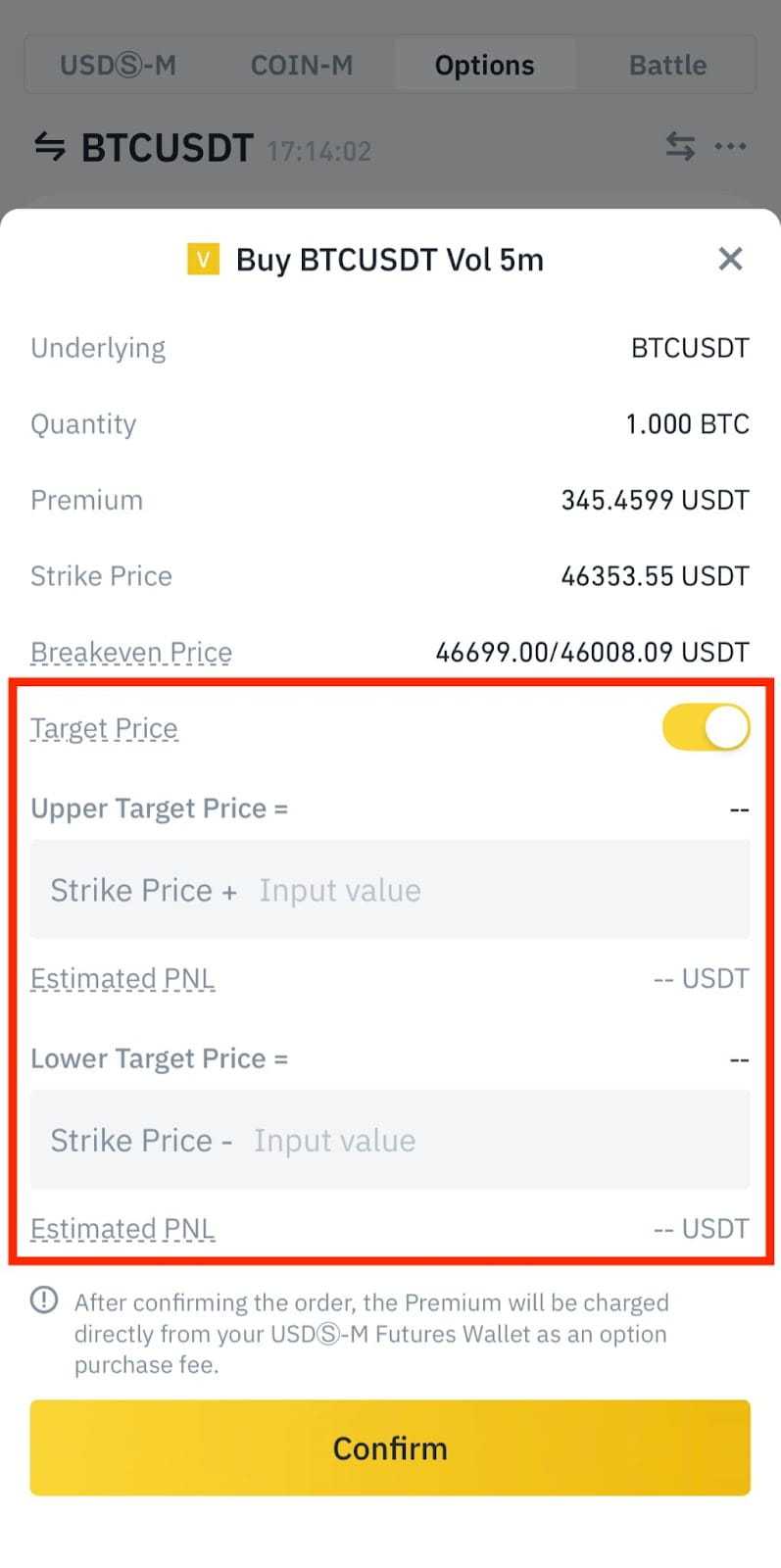

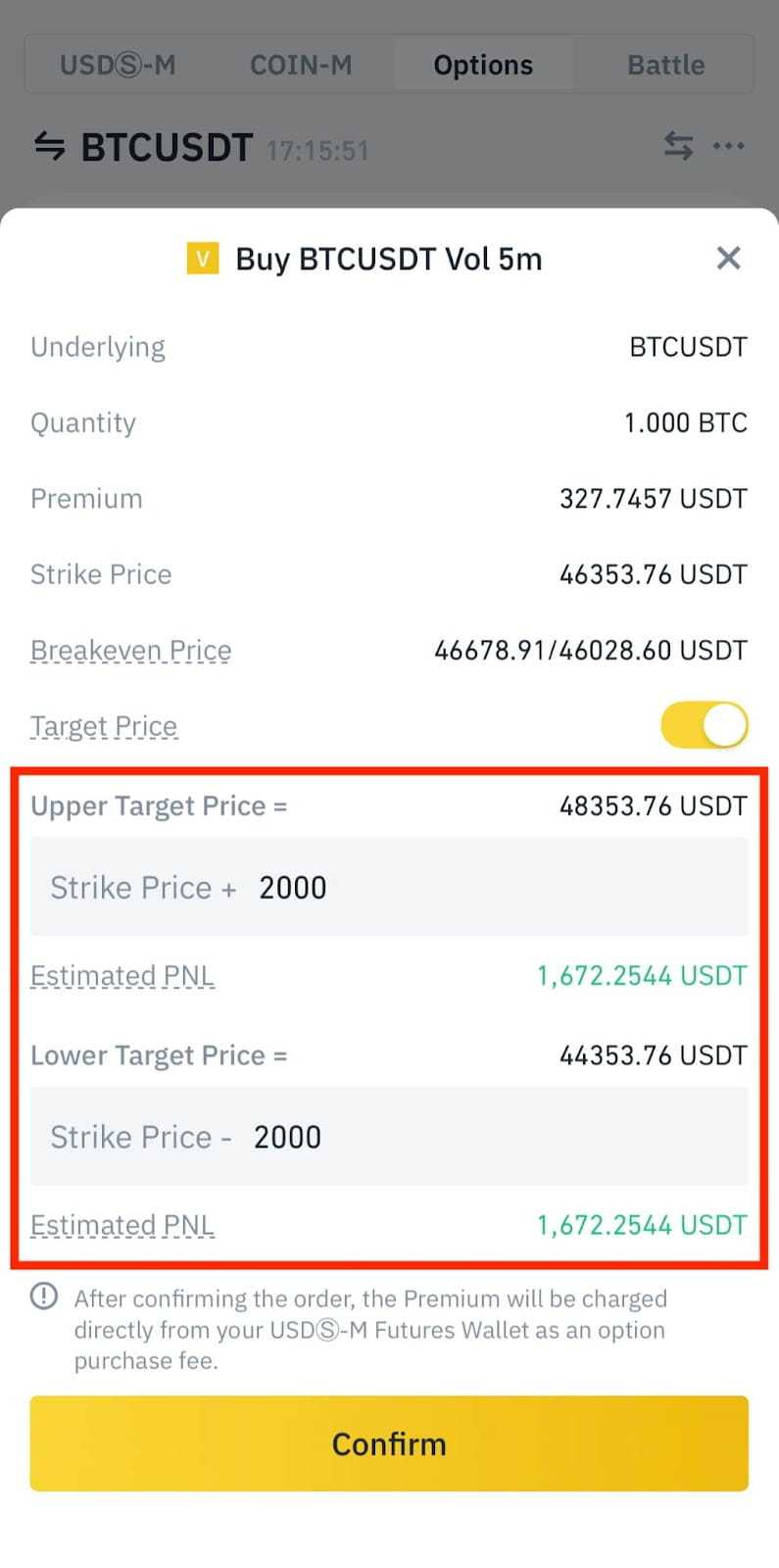

- Set the upper and lower target prices for options, then press [Confirm]

- Enter the distance (+/-) from the execution price. The PNL will then estimate the following:

Upper Target Price = Max [(Target Price – Strike Price)*Quantity – Premium, – Premium]

Lower Target Price = Max [(Strike Price – Target Price)*Quantity – Premium, – Premium]

Click [Confirm] to make a transaction.

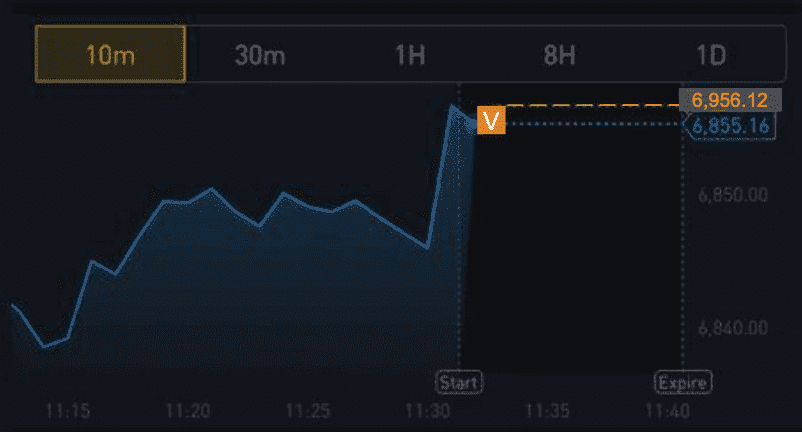

Step 4: After placing the order, the option will be shown up on the chart. Investors can view positions, unrecorded gains and losses, time to expiration, and breakeven prices in the [Position] section. see position, unrecorded gains and losses, maturity time, and break-even price.

Investors can pay the option at the strike price at any given time before the expiration date.

- Manual payment: Go to [Position] → [Settle] to see the interest and loss of the option, and then press [Confirm] to pay.

- Payment on the expiration date: the option will automatically be paid on the expiration date.

Conclusion

Vol Option is a particularly suitable choice for large capital investors who want to make more profits to increase their assets. Despite the relatively high profitability of Vol Option, investors still need to be careful. There is no guarantee that the price on the screen is the exact price at which that order is executed, although usually these two numbers are almost equal.

>>> Related: Binance registration guide update 2022.