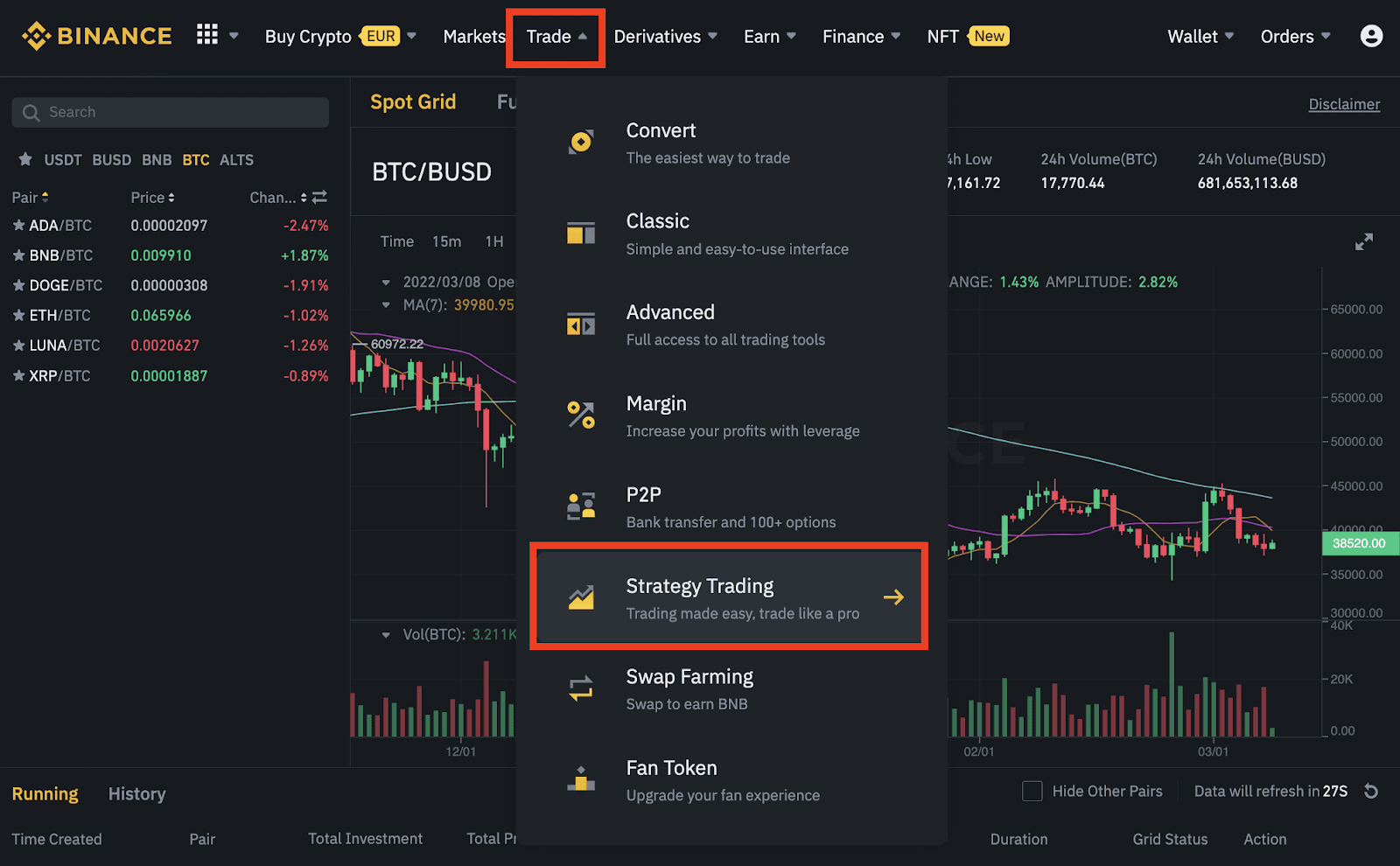

On April 14, 2022, Binance made an announcement “Binance Futures launches Volume Participation algorithm on API”. Volume Participation is part of Binance Futures execution algorithm API solutions which allows investors to take advantage of Binance algorithmic trading capability and automate their order execution.

What is volume participation algorithm?

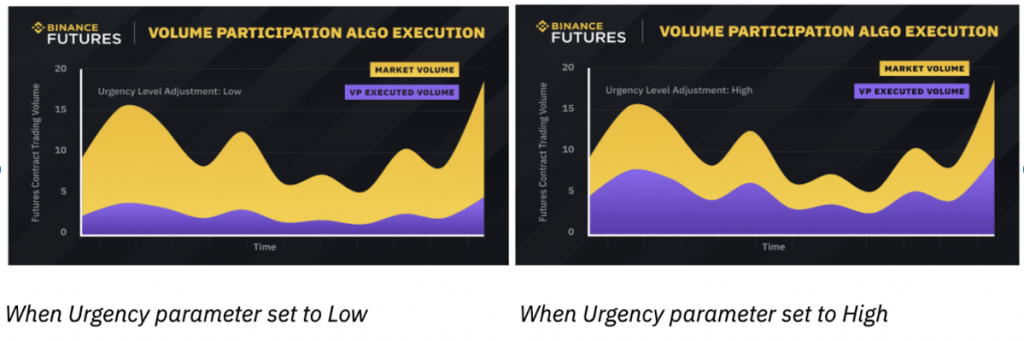

Volume Participation algorithm (VP) is a strategy executed according to the opportunistic algorithm. Depending on the level of specified urgency, this algorithm allows the investor to execute large orders with the aim of executing a trade corresponding to the market trading volume in real time through the level of target block participation.

Volume Participation is an effective solution to minimize the impact of the market on orders and towards the average market trading price during the trading period.

When to use a volume participation algorithm?

This algorithm is suitable for order execution strategies that aim to place orders that have a notional value greater than the available market liquidity. Besides, this algorithm also limit the impact on the market.

When the trading volume of the market is low, the price is stable, the market order with great notional value can affect the market price, making the executed price unfavorably. Meanwhile, volume participation orders can be executed in the average market price range without affecting the market.

If the trading volume of the market is high with price fluctuations, the market order can capture the existing liquidity of the market immediately as well as the market price movement. Meanwhile, volume participation orders can execute urgently and can cause adverse executed prices.

Effectiveness of volume participation algorithm

If the price of the market is highly volatile or the liquidity is insufficient during the order execution, this algorithm may not achieve the highest level of efficiency. Therefore, the execution of an order is always dependent on liquidity and there is no guarantee that it is matched at the highest price.

Simply put, if the market is getting tough, the algorithm may not be able to complete the order before the specified time ends.

To improve this issue, Binance combines a variety of strategies to minimize risk, especially the circuit breakers in a manual and automatic way. That mechanism is combined with the kill-switch control mechanism in the event of a market disruption, the system fails leading to the early cancellation of the Volume Participation order when the order has not been fully matched.

How to check the status of volume participation orders

To perform the test, investors can use the query endpoints (GET sapi/v1/algo/futures/openOrders or GET sapi/v1/algo/futures/historicalOrders).

Order execution operations will have no websocket notifications. Even if you receive a “success” message, it doesn’t mean that the order has been executed.

For instance, when the balance in the futures contract is not enough, or the account is in a Reduce Only status, the investor can still receive a “success”: true but in fact the order will not be executed.

Notes on Volume Participation algorithm

Although this algorithm plays important role in balancing the market with orders, in fact, it still has limitations:

- This algorithm is limited in notional value.

Notional value value is calculated by formula:

Number of orders x Mark Price (base asset).

In the Volume Participation algorithm, the notional value must be between $10,000 and $1,000,000.

- Besides, this algorithm currently only supports USD-Margined contracts.

- When giving some unsatisfactory queries, the investor will likely receive some of the following error messages:

| External code | External notifications |

| 0 | Ok |

| -1000 | An unknown error occurred when processing the request. |

| -1102 | A required parameter has not been sent, empty/null, or malformed |

| -20121 | Invalid symbol. |

| -20130 | Invalid data sent for a parameter. |

| -2013 | The order does not exist. |

| -5007 | The amount must be greater than no. |

| -20124 | The algorithm ID is invalid or has been completed. |

| -20132 | The client algorithm ID is duplicated. |

| -20194 | The time is too short to fulfill all the required number of requests. |

| -20195 | The total size is too small. |

| -20196 | The total size is too large. |

| -20198 | Reach the maximum number of open orders allowed. |

Conclusion

There is no doubt that Volume Participation plays a significant role in balancing the market, minimizing the impact of the market on orders. As can be seen, the launch of this algorithm represents the efforts of developers in supporting the trading activities of investors on the exchange.