Whether it’s traditional financial or cryptocurrency investments, building a portfolio is important. This allows investors to minimize overall risk according to their investment profiles and strategies. Simply put, balancing a crypto portfolio means diversifying investments between different currencies.

Depending on the potential of the investor, the level of diversification of each person is different. However, there is no doubt that it is beneficial in the long run thanks to reducing the risk of various cryptocurrency investment (including stablecoins). The rebalancing of the crypto portfolio must take place regularly.

Entering the cryptocurrency market is not difficult, but this requires investors to have a good knowledge. To make an informed decision, it is impossible to ignore the distribution of assets and a well-balanced crypto portfolio.

What is a crypto portfolio?

A crypto portfolio is a set of cryptocurrencies owned by investors which includes altcoins and cryptocurrency financial products. While traditional portfolios attached to only one fixed asset class, a crypto portfolio allows investors to access a verity of assets. Cryptocurrency investors can track their portfolio manually on a spreadsheet or rely on professional tools and software to calculate their holdings and profits. The tracker is essential not only for day traders but also for long-term investors and Hodler.

What is asset allocation and diversification?

Getting acquainted with the concepts and asset distribution is necessary for any investor who wants to create a crypto portfolio. Asset allocation is the investment in different asset classes, e.g. cryptocurrencies, stocks, bonds, precious metals, cash…Asset diversification is the distribution of funds invested in different assets or sectors, for example, stock investment in a variety of industries: agriculture, industry, services, energy, healthcare,…

The biggest benefit of both asset allocation and diversification is to help reduce the overall risk. In fact, cryptocurrencies are still a group of assets. Therefore, in the portfolio, investors can diversify coin and token products with different goals and conditions of use. For example, investors can allocate crypto portfolios with 50% of capital invested in Bitcoin, 20% in stablecoins, each 15% in NFT and Altcoins.

Concentrated and diversified crypto portfolios

A new investor should focus on diversifying the portfolio. As mentioned, a diversified portfolio can minimize the risk of damage and overall volatility. Profits can make up for losses. That’s why investors retain their position in the market. While not all investments are profitable, the diverse and reasonable distribution of their assets will help investors earn a steady return in long run.

However, to diversify crypto portfolios, investors have to keep a close eye on the market. In fact, most investors try to beat the market with greater gains. Investment assets that generate good returns play a balancing role with underperforming assets. A portfolio with a high level of diversity is likely to be more profitable than a concentrated portfolio.

However, managing a diversified portfolio requires investors to have knowledge and a lot of time to research and analyze the market. To invest effectively, investors must understand what they want and build investment strategy. Therefore, if the portfolio is located on different blockchains, investors must use a variety of wallets and exchanges to access their assets. This may seem difficult but it is the choice and investment mindset of each person, and diversification is always recommended.

Cryptocurrencies and financial crypto products

Cryptocurrencies

According to market capitalization, Bitcoin (BTC) is the largest and most famous cryptocurrency. However, a balanced crypto portfolio will always include many different cryptocurrencies to reduce overall risk. Below are some cryptocurrencies.

- Payment coin

Today, the issuance of a new currency is no longer just for trading and payment purposes. However, back to the advent of cryptocurrencies, most projects are systems for transferring value such as Ripple (XRP), Bitcoin Cash (BCH) or Litecoin (LTC),… These were the first generations of cryptocurrencies born before both Ethereum and smart contracts. Payment coin

- Stablecoin

This is a cryptocurrency that pegs the price according to a basic asset class such as fiat money or precious metals, gemstones. While stablecoins aren’t as profitable as other currencies, they are likely to offer stability, just like the name implies.

For example, BUSD coins are pegged in U.S. dollars with reserves placed at a ratio of 1:1.

PAX Gold (PAXG) using the same system but linking each coin to the price of an ounce of gold held in reserve. Investors should build a stable crypto portfolio. Meanwhile, stablecoin pegs something outside the crypto ecosystem to lay the value base. If an investor wants to move any coin to another, stablecoin is a good option as it is secured by a fixed asset. This can protect assets as effectively as fiat money. However, the process of converting from a cryptocurrency to a fiat currency is more time-consuming than the conversion to stablecoins.

- Tokens

-

Security tokens

A security token can represent many things, not just traditional securities. For example, it could be equity in a company, bonds issued by a project, or voting rights. What’s more, securities have been effectively introduced into the blockchain with the same basic regulations as traditional securities. Therefore, securities tokens fall under the jurisdiction of local regulators and must go through legal processes before being issued to the market.

-

Utility Token (Utility Token)

These tokens are keys to a service or product (e.g. BNB, ETH, etc.). Investors can use utility tokens to pay transaction fees with decentralized applications (DApps) in a variety of utilities. Besides, many projects also release their own utilities to raise capital in an offering. The value of any token must theoretically be linked to its utility value.

-

Governance Token (Governance Token)

Investors can participate in a vote on a project or a portion of revenue by holding governance tokens. Investors can find these tokens in decentralized financial platforms (DeFi) such as PancakeSwap, Uniswap or SushiSwap,… Similar to utility tokens, the value of governance tokens also directly affects the success of the project.

Financial Crypto Products

Not only does a diversified portfolio hold different cryptocurrencies, it also hold different cryptocurrency financial products. On blockchain and DApps, there are a large number of financial products that investors can consider.

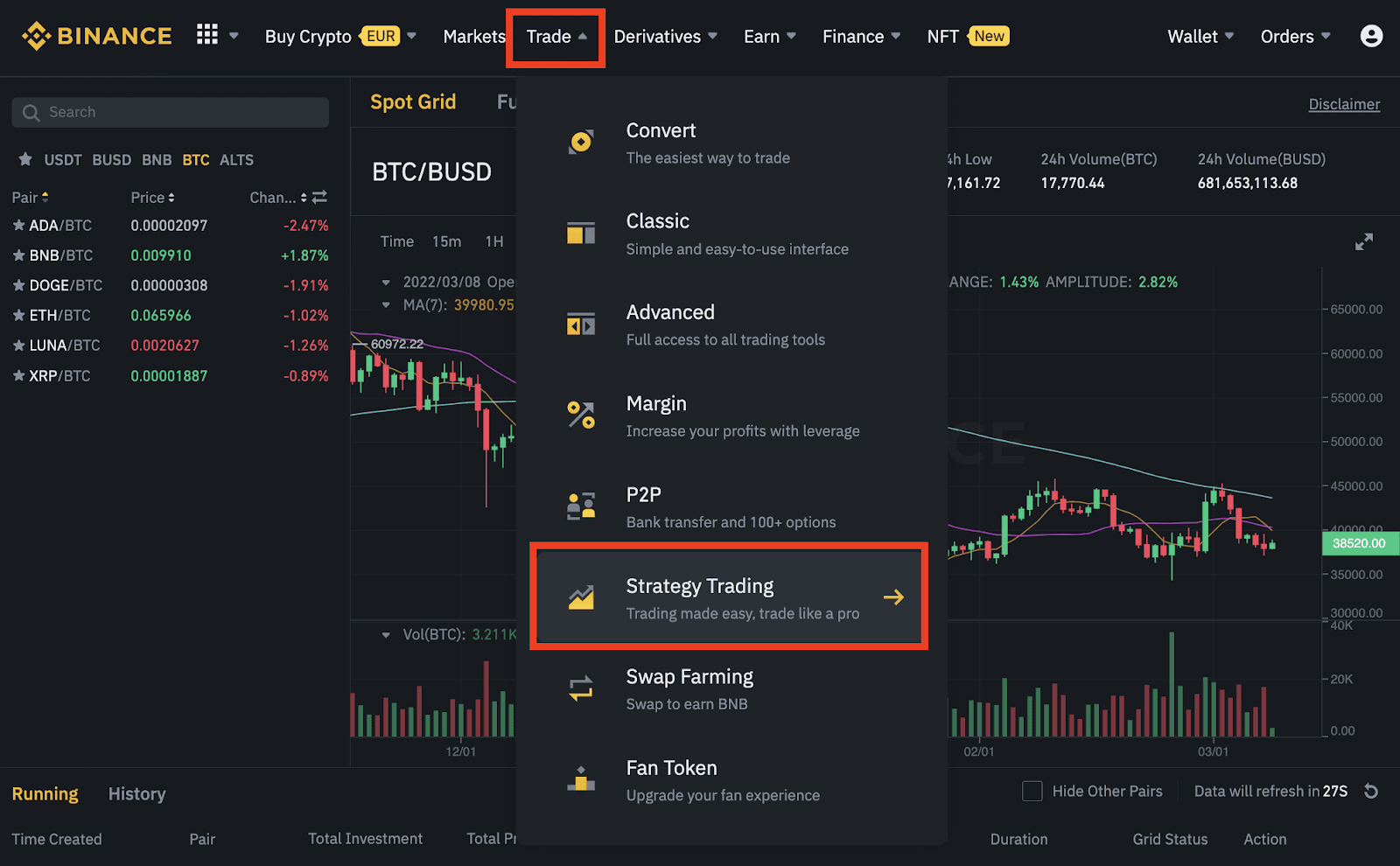

Binance offers a variety of products. Investors can go to the Finance section on Binance homepage for reference. However, each product has different levels of risk, so before you decide which product to invest in, to avoid risks, learn its mechanism of action carefully.

Build a crypto portfolio

Each investor has their own strategy to build a crypto portfolio. However, they are all built according to the principle:

- Divide portfolios based on the correlation between risk and return from high to low and then set the proportion for them;

- Consider holding some stablecoins to provide liquidity to your portfolio;

- Rebalance the portfolio regularly;

- Develop a capital distribution strategy, avoiding placing too much emphasis on any one area in the portfolio;

- Carry out your own research through technical indicators, not entirely relying on the advice of others.

- Anticipating risks, only invest what can afford to lose.

Crypto Portfolio Tracker

This is a computer program or service that allows tracking of assets in holdings. Investors can assess how the current investment distribution is appropriate and make an informed decision. Here are some effective trackers that investors can refer to:

- CoinMarketCap: an extremely popular price tracker that is available on both desktops and mobile devices. To use its own portfolio feature, the investors have to manually add their holdings, because it does not connect to the wallet or exchange that you use.

- CoinGecko: It have not only cryptocurrency price tracking feature but also a portfolio option. Like CoinMarketCap, this is also free on mobile phones and computers.

- Blockfolio: It allows to trading and manage portfolio at the same time. The company has been in operation since 2014 and is quite well known in the cryptocurrency industry. However, the app does not offer a desktop cryptocurrency trading experience.

- Delta: It is available on mobile devices but cannot be traded in the app. Investors can simultaneously view of cryptocurrency portfolios and traditional investments. It can connect to 20 exchanges and a variety of wallets, including Binance. There are both free and paid versions, but cannot be traded in the app.

Conclusion

In short, the allocation, diversification of assets and the establishment of a portfolio are the basic concepts of investment management and activities. Bitcoin’s health greatly affects the cryptocurrency market. But building and balancing your own portfolio will minimize the risk when the market fluctuates. When Bitcoin crashes, investors don’t lose their entire funds because other assets will offset that loss.

A well-balanced crypto portfolio is a wise investment strategy that help investors hold a variety of asset and earn great profits.

>>> Related: Guide to sign up for Binance account update 2022