What is Binance Savings?

Binance Savings is a simple cryptocurrency saving function to make profits for investors. It allows users to deposit cryptocurrency to Binance Savings wallet. Binance will lock this asset and provide daily interest for the senders.

Binance Savings is one of the initial products of Binance Earn.

Investors not only earn a profit from their crypto funds but also have the opportunity to receive dual savings if the price of that coin rises. At that point, their profit also increases. On the contrary, if the price of that coin falls, their profit may not reach the expected value.

Eligibility to participate in Binance Savings

Investors must register a Binance account and verify identity (KYC). They can deal with risks of falling in price when depositing crypto. Therefore, they need have a good knowledge of the deposited coin to avoid losing assets in case the coin goes down in price.

How to use Binance Savings

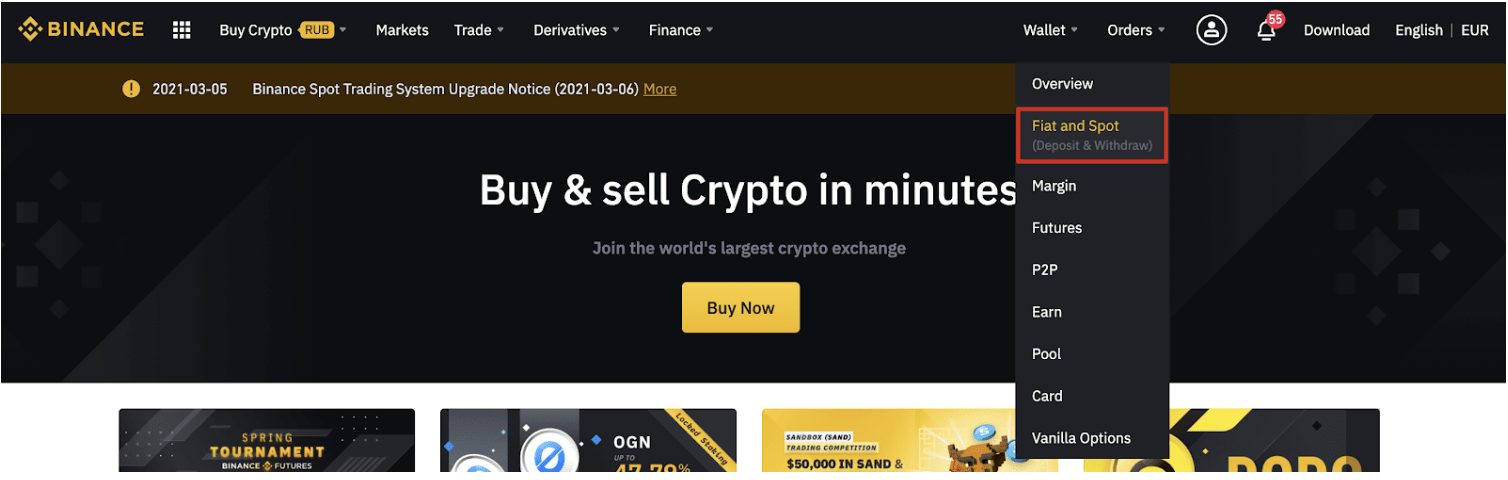

Step 1: Log in to your Binance account. Click [Earn] then select [Savings]

![Click [Earn] then select [Savings]](https://wikibinance.com/wp-content/uploads/2022/05/click-earn-then-select-savings-750x314.png)

![Click [Subscribe]](https://wikibinance.com/wp-content/uploads/2022/05/Click-Subscribe-1-750x375.png)

Types of Binance Savings

Currently, Binance is offering investors two forms of savings:

- Flexible Savings: Investors can withdraw coins at any time, but the interest rate is relatively low, only 1-7%.

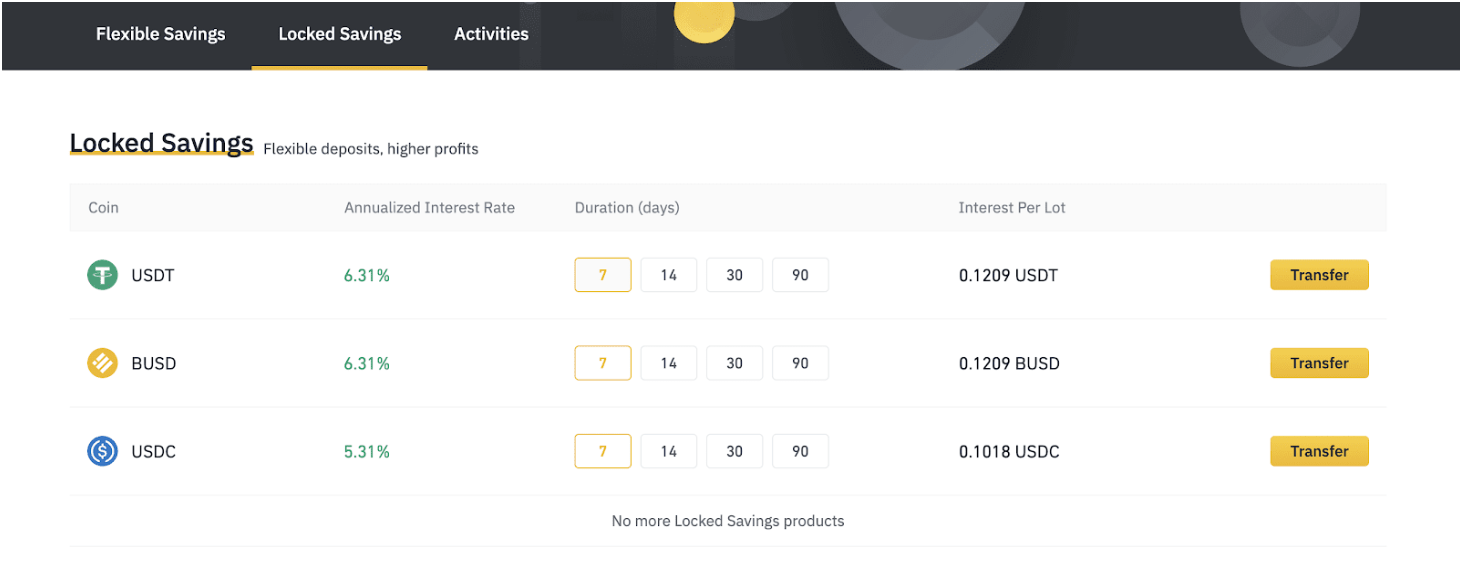

- Locked Savings: the amount of coins will be locked in a certain period of time (14/30/60 days), but the interest rate is relatively high, at 15-25%.

| PROPERTY TYPE | FLEXIBLE SAVINGS | LOCKED SAVINGS |

| INTEREST | Variable interest rates | Fixed interest rate for 7-14-30-60 days |

| PROS | Easy to withdraw coins you have deposited at any time

Allow to earn interest through automatic feature |

Higher interest rates than flexible savings

Rates will not change over the period of time you deposit |

| CONS | Lower interest rates

Rate fluctuates according to market condition and user’s demand |

Coins will be locked for a certain period of time

Unable to withdraw before the maturity date |

| OBJECT | Suitable for those who want to flexibly hold the coin, can make transactions at any time | Suitable for those who are confident about the growth of the coin they hold, hold coin in long term |

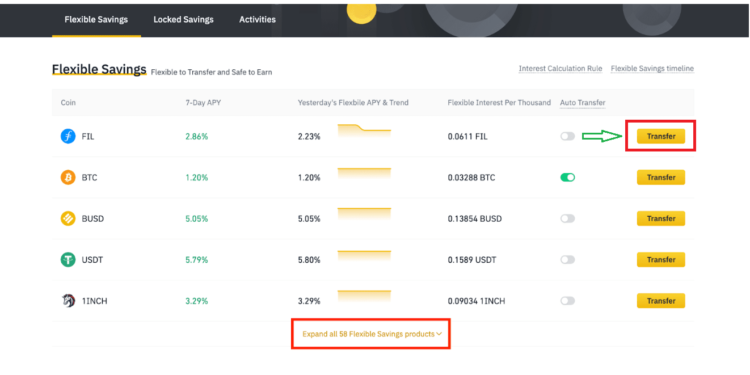

Flexible Savings

Terms:

- The average annual return (ARR) is calculated by multiplying the past seven days’ average daily interest rate by 365. This is the daily reference figure that the investor receives, but it is unlikely that the investor will receive such a profit. There is always a margin of error because it bases on past figures to predict future interest rates.

- Daily interest per thousand coins or tokens of a particular asset is based on the latest daily interest rate.

Registration and redemption

- Investors can register and redeem at any time. The amount of crypto will be recorded in real time and it will not take time to process.

- From 00:10 to 23:50 (UTC) every day, subscription and redemption periods are available.

- The interest is calculated after the day the investor registers, excluding the date of registration. Interest is received after two days of registration.

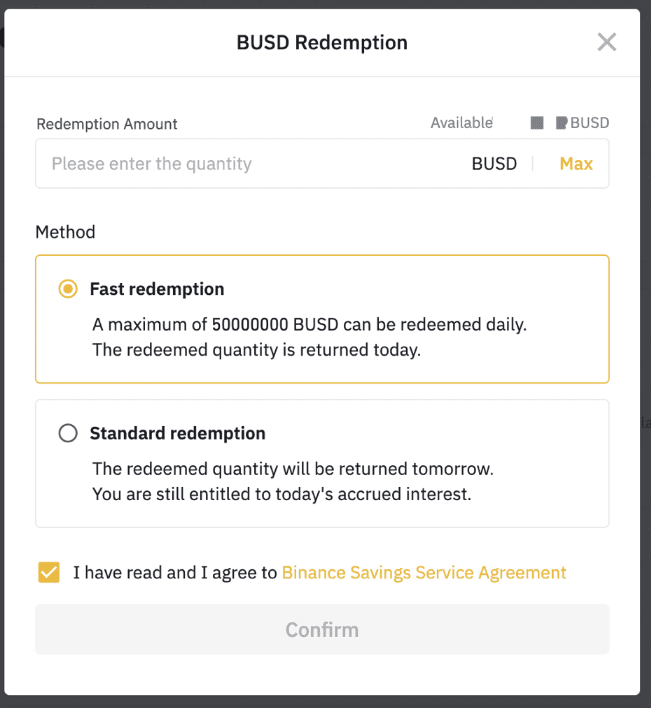

- Investors can choose between fast redemption or standard redemption to redeem your assets on the day of registration. For the standard redemption, all funds and interest will be refunded at 0:00 A.M (UTC) on the second day after the redemption. The process of calculating interest may result in delays in in funds credited. At that time, the interest calculation period also includes the withdrawal day. For the fast redemption, the investor will get your entire digital asset value on the day of redemption but not receive interest.

How to use it

After proceeding with the steps above, select Flexible Savings and click Expand all Flexible Savings products. Then tap Transfer.

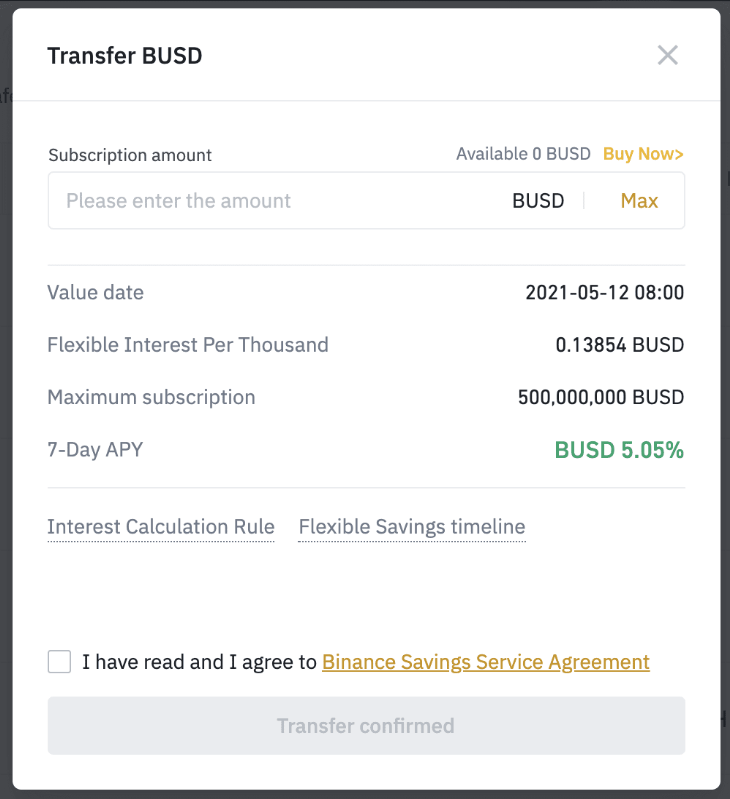

After that, the withdrawal window will appear. Make sure that you have enough assets and your holdings are not in the open orders or margin account. At this time, you proceed to enter the number of lots, the system will calculate the expected interest after redemption. Agree to the terms and press Transfer confirmed to proceed.

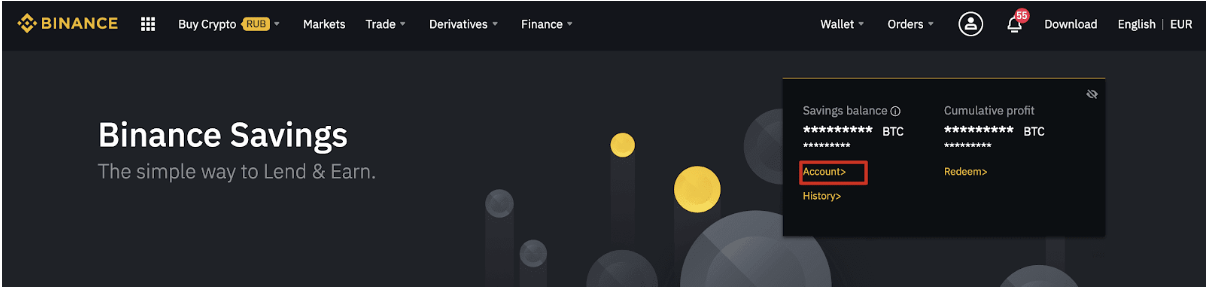

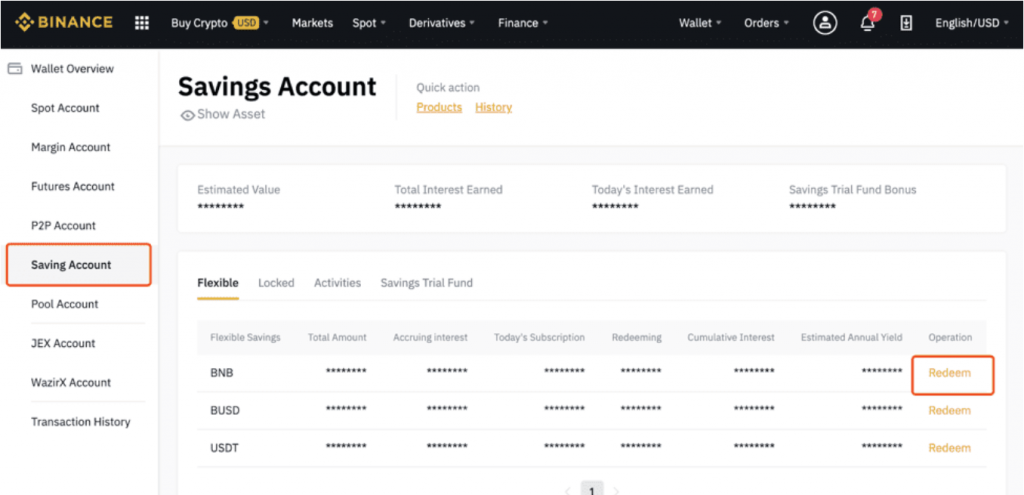

Once confirmed, the system will transfer registered funds from the spot wallet to the savings, you can review the registration by tapping Account on Binance Savings.

To withdraw funds, select Wallet then click Fiat and Spot.

Press Redeem to withdraw. At that time, the principal and interest will be recorded at the same time and can check the balance in the list of assets.

Enter the redemption, select the redemption method, and then press Confirm.

Locked Savings

Similar to the flexible savings feature, Locked Savings is also one of the financial products that Binance offers to increase the cryptocurrency assets of investors. Investors can set up this feature at any time and earn passive income from their holdings. Their interest earned will be forfeited if they withdraw it before the maturity date. Therefore, the terms and the way of calculating interest rates are much simpler than Flexible Savings.

How to use it

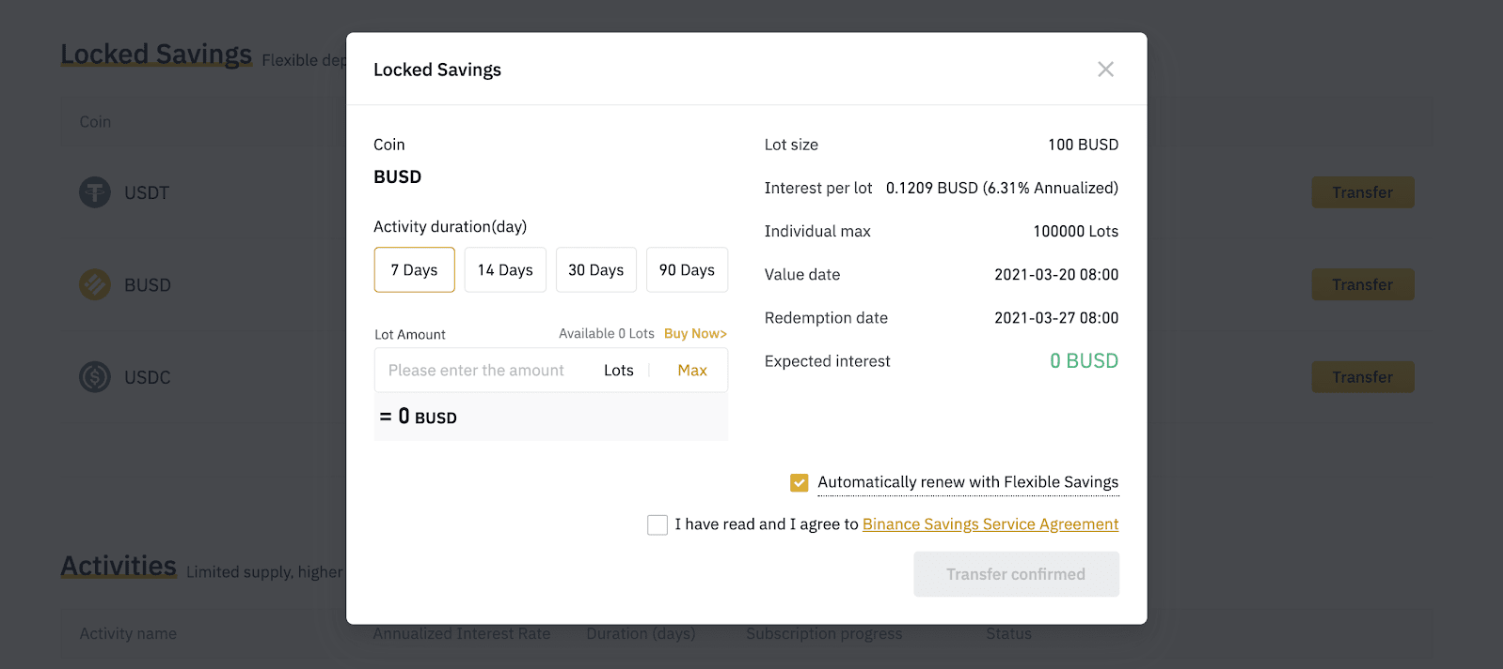

The way to use Locked Savings is also relatively simple. After taking the steps as initial instruction, press Locked Savings to see the annual interest rate and fixed term of each asset. Select the currency you want to transfer, and then press Transfer to confirm the registration information.

The system will automatically charge the expected interest after the investor has entered the number of lots. Make sure there is enough balance in the Spot wallet before pressing Transfer confirmed to confirm.

The system will then transfer funds from spot wallet to Earn wallet, you can check the registration history by clicking Account.

By the repayment deadline, the locked asset with interest will be automatically withdrawn and returned to your Spot wallet. At this time, you can check their spot wallet balance as usual.

Conclusion

Binance Savings is a useful tool to help investors to make profits from their holdings without making buying and selling transactions. This is a long-term investment when there is no good trading opportunity.

For those who don’t like day trading, Binance Savings is the best choice without risk. However, what form of Savings is used for which coins, how long the term is, still should be carefully considered. Because the value of that cryptocurrency in the market has a relatively huge impact on the level of interest that investors can receive.