What is Binance Dual Investment?

Binance Dual Investment is a non-principal protected structured saving product, allowing users to deposit cryptocurrencies and earn flexible yield in either two assets. Users will deposit Binance Dual Investment products with different prices, execution dates and interest rates. Interest will be returned to the Spot wallet at the date of implementation.

Some terms to grasp

- Delivery date – The day you can get your cryptocurrency back along with the amount of interest earned.

- Target Price: The set price at which the unit of the deposit will be converted into an alternative currency if the product is exercised.

- Strike price – The fixed price determines what currency you will be paid.

- Settlement price – The spot price of the underlying asset at 8:00 (UTC) at the delivery date.

- Annual Percentage Interest (APY) – The interest you get if you have locked your cryptocurrency in a Dual Investment product for a year (including compound interest). For example, if your APY is 36.5%, then your daily estimated interest rate is 36.5%/365 days = 0.1%.

- Underlying assets – The reference assets in dual investment products. For example, if you submit a BUSD and bet on the BTC price that will go down, then the underlying asset is BTC. Strike price Price, Spot Price and Settlement Price are all tied to the underlying asset.

Product classification

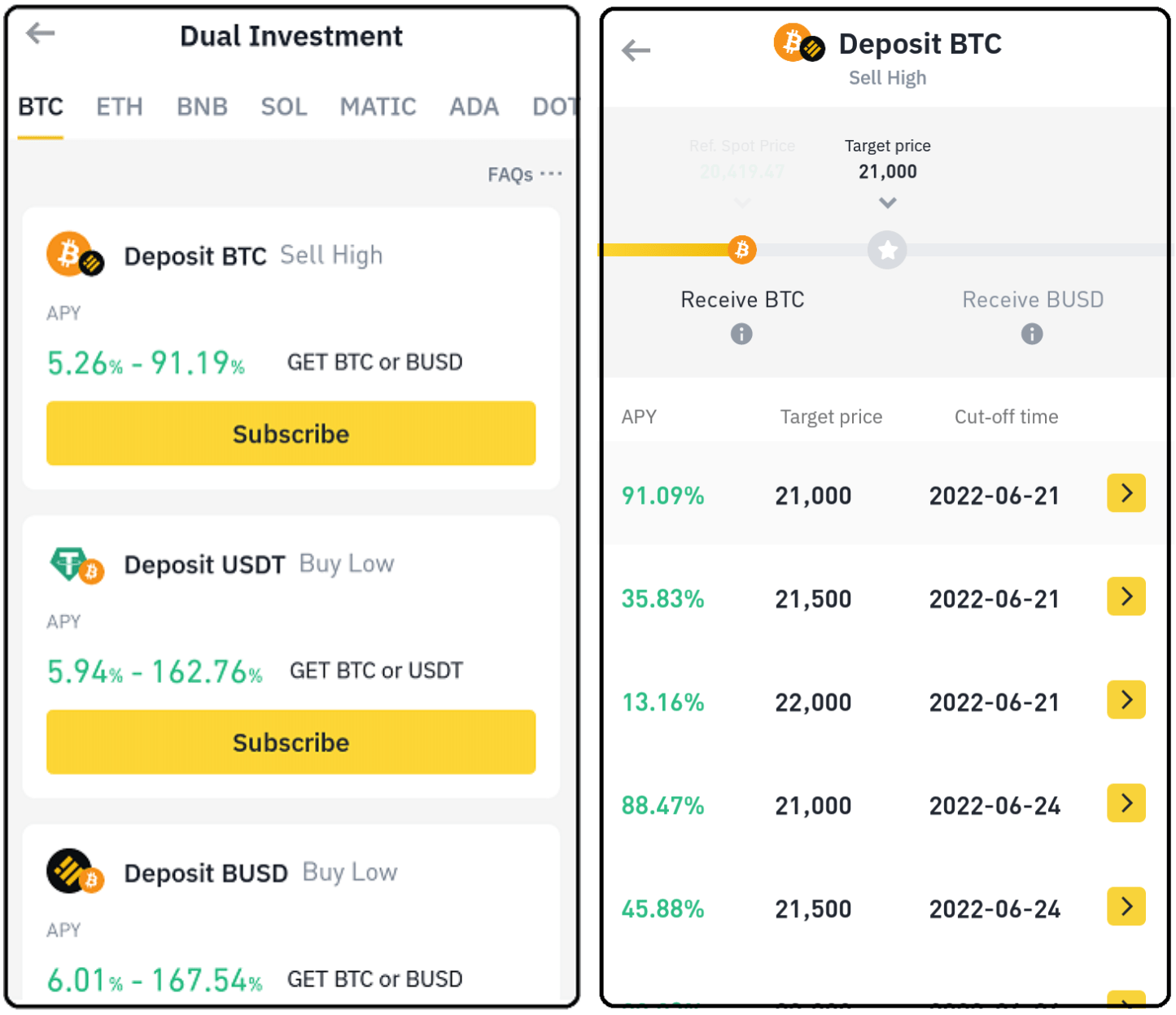

There are two types of Binance Dual Investment products: (1) Sell High and (2) Buy Low.

Sell High

– The product is “exercised” if settlement price ≥ target price

– The product is “not exercised” if settlement price < target price

Buy Low

– The product is “exercised” if settlement price ≤ target price

– The product is “not exercised” if settlement price < target price

For both product types, you will receive a profit in deposit currency if the product is not exercised. You will receive a profit in the alternative currency if the product is exercised.

Benefits of Binance Dual Investment

- Buy low or sell high: You can buy cryptocurrencies at low prices or sell cryptocurrencies at high prices;

- High interest yields: You will earn a high passive income regardless of which direction the market goes;

- Diverse options: You can select from a wide range of assets and set the target date and price you want;

- No transaction fees: You don’t have to pay a trading fee when you reach your goal and the “Buy Low” or “Sell High” order is executed.

Why should you use Binance Dual Investment?

- Take profit: Sell the cryptocurrency that you are holding with target price to benefit from the investment with high yields;

- Buy low: Buy cryptocurrencies at the target price when the market is down and earn high-interest yields;

- You have multiple products to compare and select at the same time through Binance Earn set of products;

- Increase your crypto assets: You have cryptocurrencies and want to make more profit;

- Increase stablecoins: You have stablecoins and want to make more profit by holding them.

How to calculate profit

The profit received is based on whether the Binance Dual Investment product is exercised and your subscription amount is converted into the alternative currency.

For the product to be “exercised”

Your subscription amount and interest income will be converted into alternate currencies with the target price being the conversion rate. The formula below indicates the total amount you will receive:

- High selling:

(Subscription amount * Target price) * [1+ (% APY * Deposit Days / 365)]

- Buy low:

(Subscription amount / Target price) * [1 + (APY% * Deposit Days / 365)]

For products that are “not exercised”

The your subscription amount and interest income will not be converted and you will receive in deposit currency. The formula below indicates the total amount you will receive:

Subscription amount * [1 + (APY% * Deposit Days / 365)]

Notes when investing in Binance Dual Investment

Is the target price and APY fixed?

The target price is fixed and will not change. Sometimes, a new subscription may be temporarily discontinued if the target price is too close to the current reference price.

APY is always changing and this mainly depends on the target price, the number of remaining deposit days, and also the price movement. After you have signed up for the Dual Investment product, APY will be locked during the deposit days and will not change.

Is it possible to cancel or withdraw the registered capital?

It is not possible to withdraw early with Dual Investment products and cannot be canceled after registration.

When is the profit returned?

Your investment return will be calculated on the Settlement Date at 08:00 UTC. You will receive your returns in your Spot Wallet within 6 hours.

How to view trading order history

You can see the trading history at Orders/Binance Earn/Dual Investment

Should I join dual investment or not?

- Orders executed: Losses if the price rises sharply but there is an additional profit.

- If the order is not executed: Preserve the capital and make a profit.

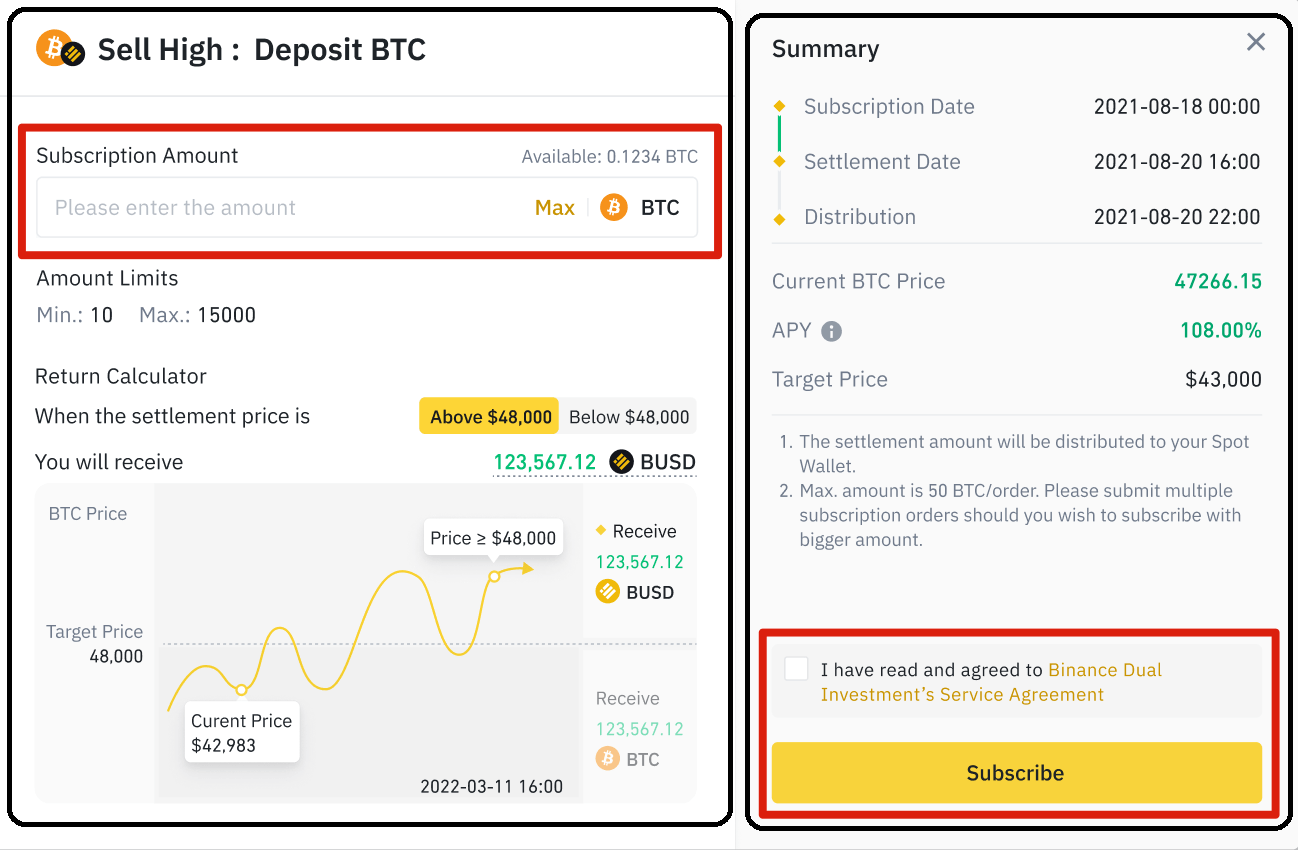

How to use Binance Dual Investment

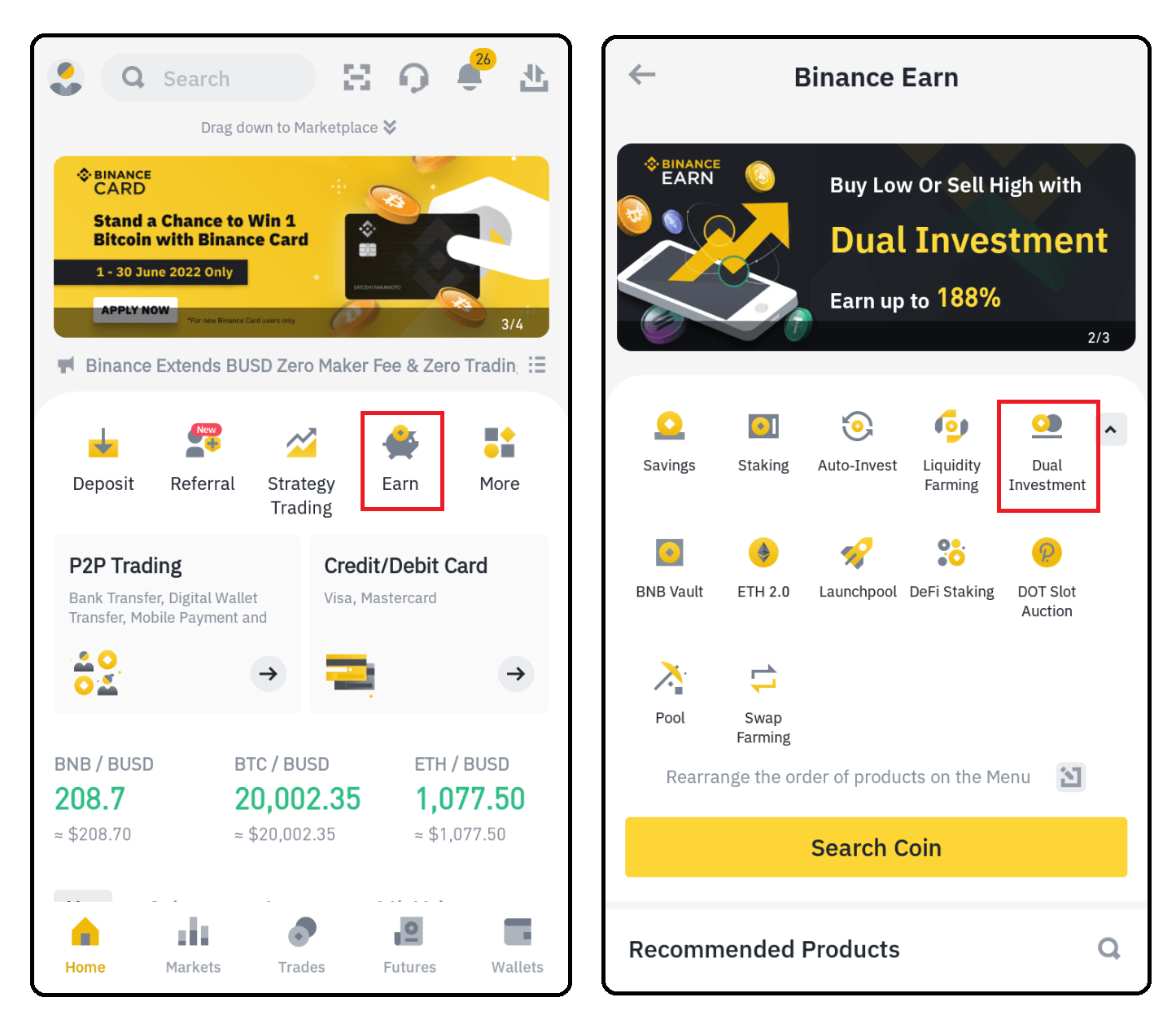

Step 1: At the Binance App homepage, you select Earn and then choose Dual Investment.

Step 2: A list of products with specifics will appear for you to register. Look for the cryptocurrency you want to invest in. You will see APY and the current Market Price of the asset. Click on the asset to get started.

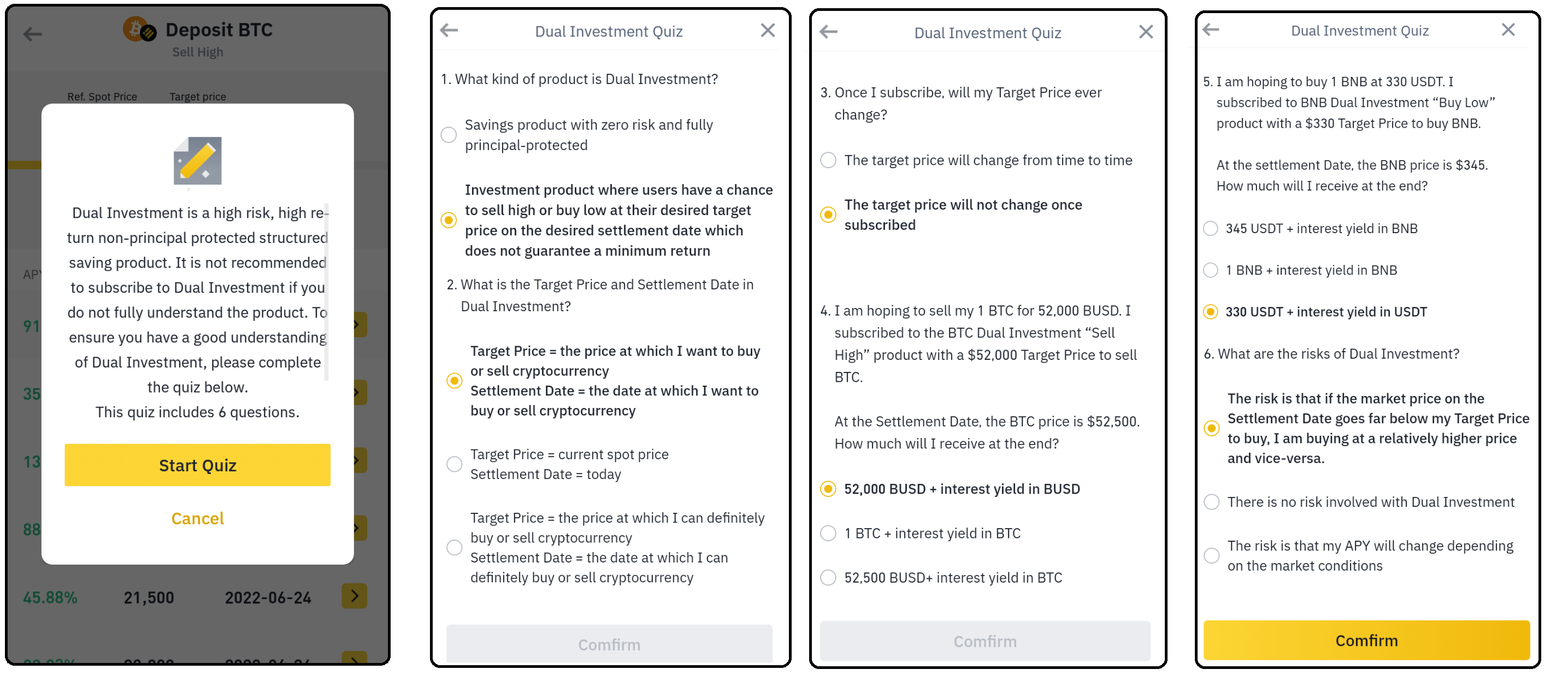

If it’s your first time participating, Binance will have questions to check, you need to answer them correctly to confirm.

Step 3: Enter the number of cryptocurrencies and agree to Binance’s terms, you press Register.