UST/LUNA is an unfortunate incident and affects many people. At Binance, the exchange’s primary focus is on protecting affected users. But sadly, in this case, there is no solution that can satisfy everyone. Many proposals have been discussed in the community but they all have certain drawbacks.

Lessons learned

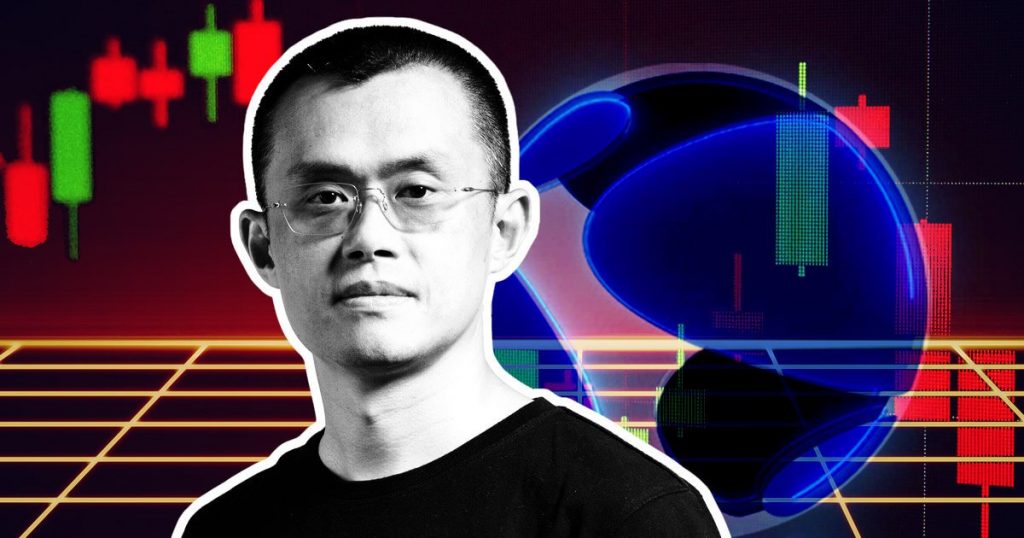

First of all, let’s look at the design flaws. Theoretically, when you anchor the price of a property using another asset as a mortgage, there will always be a risk of a mortgage below or fluctuating above the anchor level. Even if the mortgage exceeds 10 times, the mortgage can fall more than 10 times. Nothing is 100% stable in the world. The stupidest design mistake is to think that casting more assets will increase the total value (market capital). Just as printing more money doesn’t create extra value, it only reduces current holders. So creating more LUNA only makes the problem worse. “Whoever designed this should go for a neurological test,” CZ said. Another fundamental error is the excessive forms of incentive, namely anchor’s fixed 20% APY to drive growth. You can use incentive forms to attract users to your ecosystem. But at the end of the day, you need to generate income to maintain it, the profit has to be greater than the cost, otherwise you will run out of money and go bankrupt. However, in this case, the concept of “income” is quite confusing because the project team may have included token revenue in luna’s value as “income”. This approach is wrong. Everyone participated because of luna’s incentives and increased value. However, they give incentives to people but do not create value.

High APY doesn’t mean healthy project

The current state of affairs suggests that all these forms are built on a shallow and self-sustaining model. Terra already has an ecosystem with many practical applications, but the growth rate of this ecosystem does not match the speed of incentives used to attract new users. “This growth is hollow,” CZ said. So the lesson here is not to chase high APY but to care about the basics.

Attempt to recover anchor price failed

Terra did not promptly use their reserves to recover anchor prices. This problem could have been avoided if they had used their reserves when the price fluctuated 5% above the anchor level. After the value of the coin had lost 99% ($80 million), they tried to use $3 billion to rescue it, but of course it was unsuccessful. In this case, the incident is not like a scam but just stupid. The second lesson is to always act sensitively to the situation. Terra also communicates with his community not quickly and infrequently, causing users who trust them to eventually leave. The third lesson: always communicate regularly with the user, especially in times of crisis. In the end, CZ expressed uncertainty over Terra’s recovery plan, but he insisted he would always support the community’s decision.

Is there a spillover effect?

CZ insists that this incident will definitely cause a ripple effect. USDT fell to around 0.96 but quickly recovered. Many cryptocurrency projects have been and still are negatively affected in many ways. Most of the price of cryptocurrencies has fallen. Even Bitcoin is down about 20%. Many have withdrawn capital from high APY projects. But if you really consider it, this may not be a bad thing in the long run. Many shocks can be helpful in building a solid foundation. Many sustainable projects can actually benefit. BUSD anchored the price of 1.1 and there has been a lot of capital flowing in the past weeks.

Resilience in the cryptocurrency ecosystem

CZ said that in essence, he is satisfied with the resilience of the cryptocurrency industry. When it collapsed, the size of both UST and LUNA was larger than Lehman Brothers. Bitcoin dropped only about 20 percent from $40,000 to $30,000. This often happens even when there is good news for Bitcoin. Overall, most other projects are fine. One thing that people who are accustomed to centralized systems don’t understand about decentralized systems is resilience. In a centralized system, all banks operate the same because regulations require them to do so. They all take reserves from the central bank, and when one bank goes bankrupt, it has a ripple effect on other banks. In a decentralized system, all stablecoins work differently. There is no common standard or reserve. When one project goes bankrupt, other projects are less affected.

Will regulators take a more draconian view of stablecoins after this incident?

CZ said he has received many encouraging responses from regulators he has worked with. He also believes that we need more regulation of how stablecoins work. “We definitely need to pay more attention to algorithmic stablecoins, but we shouldn’t let a bankrupt company kill the entire industry. We should continue to drive development,” one regulator said.

How to avoid such systemic risks in the future

As an investor, you should diversify your capital. Don’t put all your savings into one coin because it has a high APY. In fact, stay away from projects with high APY mutations, these projects will not last long. High APY is equivalent to high risk. The most important thing is to educate yourself, to acquire financial knowledge every day.

>> Read more about Binance: Binance UK joins UK Fintech founders’ association