The world’s largest cryptocurrency, Bitcoin (BTC), has held steady gains for the first week in a 10-week period. To date, Bitcoin is trading up 4% at $30,990 with a market capitalization of $589 billion. On the weekly chart, Bitcoin is up 2.32%. On the technical chart, Bitcoin is still trading above the 200-day moving average (DMA). Historically, BTC has bottomed out around 200 DMA or lower, i.e. down 25% from current levels. Cryptocurrency analyst Rekt Capital explained: “Historically, BTC has tended to bottom out at ambient levels or just below the 200-week MA (orange) $BTC will need to drop another -25% from the current price to the bottom at 200 MA.”

Analysis of Bitcoin (BTC) On-chain data

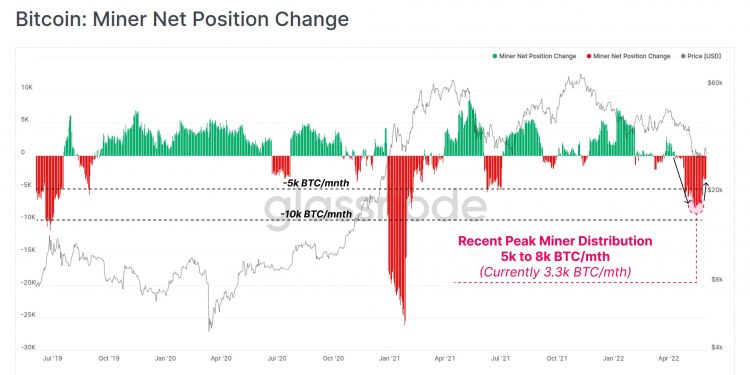

According to data from Glassnode, Bitcoin miners have sold a lot during the recent market correction. The data provider noted: “Bitcoin miners have been net distributors since the recent sell-off. Miners’ balances have recently declined at a peak rate of 5 thousand to 8 thousand BTC per month ($150 million to $240 million with $30,000 BTC). Their spending slowed this week to $3.3 thousand BTC/month.”  Citing data from Coin Metrics, Bloomberg data shows that Bitcoin miners transferred nearly 200,000 BTC to exchanges in the last month of May. Some sellers include leading publicly listed mining companies such as Riot Blockchain. Will Foxley, chief content officer of mining hardware market and storage service provider Compass Mining, told Bloomberg: “I think miners are just talking about the macro environment and think it’s probably prudent to sell Bitcoin at these levels to keep operations safe.” >>> Binance Registration Guidelines are full of new updates. most 2022

Citing data from Coin Metrics, Bloomberg data shows that Bitcoin miners transferred nearly 200,000 BTC to exchanges in the last month of May. Some sellers include leading publicly listed mining companies such as Riot Blockchain. Will Foxley, chief content officer of mining hardware market and storage service provider Compass Mining, told Bloomberg: “I think miners are just talking about the macro environment and think it’s probably prudent to sell Bitcoin at these levels to keep operations safe.” >>> Binance Registration Guidelines are full of new updates. most 2022